- LiveBetter

- Invest Better

- Online Account Opening for HK Permanent Resident via DBS digibank HK

- Online Account Opening for Mainland Chinese Resident via DBS digibank HK

- Get started with DBS digibank HK

- Two-factor Authentication

- One Time Password

- Secure Device

- Peek Balance

- Fingerprint or Face ID Login

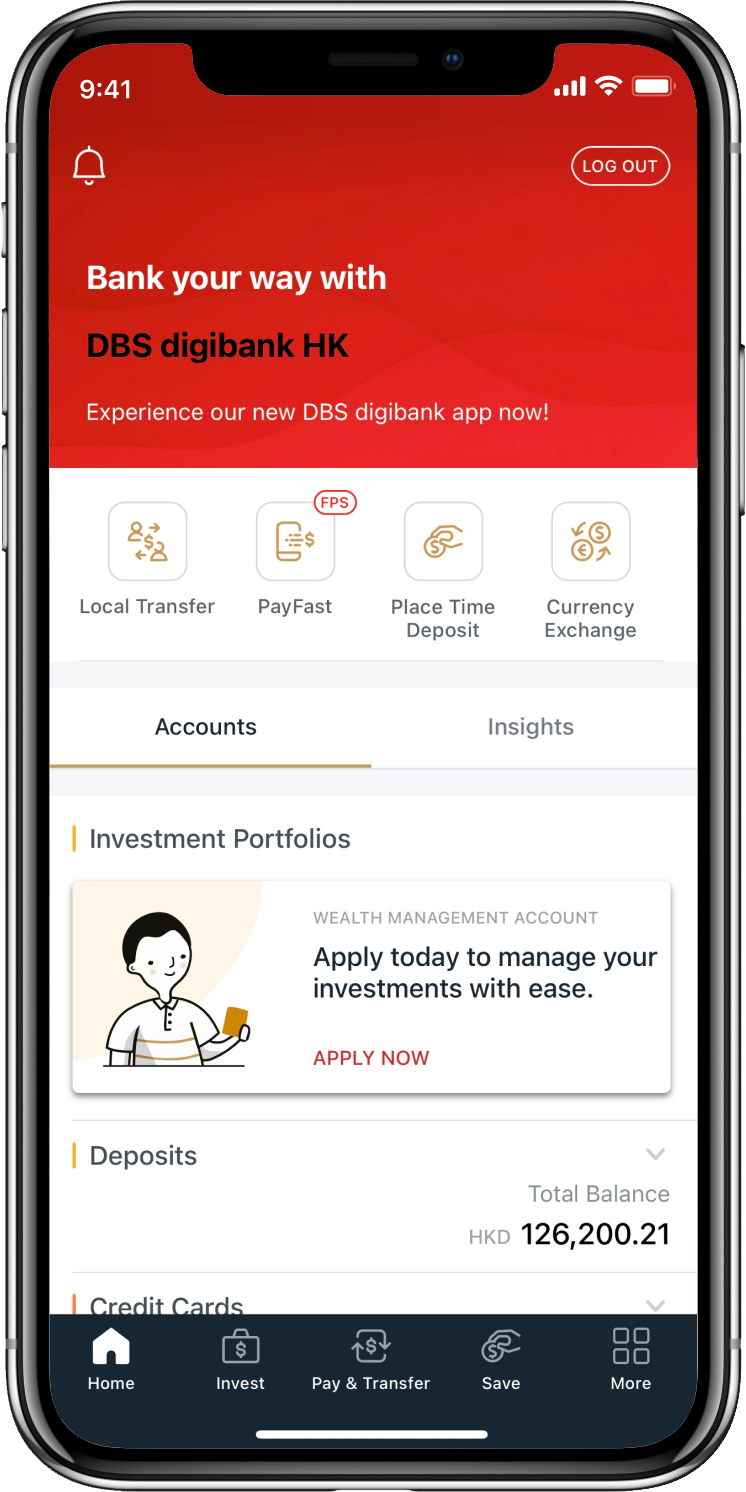

- Account Overview

- Dormant Account Temporary Reactivation

- Transfer Funds

- Pay Bills

- Online Fund Investment

Frequently asked questions about investing fund online - Investment Account Management (IAM) : Exclusive for Wealth Management Account

- Financial Needs Analysis

- Virtual Asset Knowledge Test

- Trade Securities

- Time Deposit

- GBA Wealth Management Connect (Southbound)

- Suspend or cancel DBS iBanking / DBS digibank HK service

- Bank Account Closure

- Open Banking

LiveBetter

LiveBetter is accessible through the DBS digibank HK app. There are several entry points to LiveBetter:

a: Post-log-in under the ‘Home’ tab:

LiveBetter product card below banking and credit card accounts

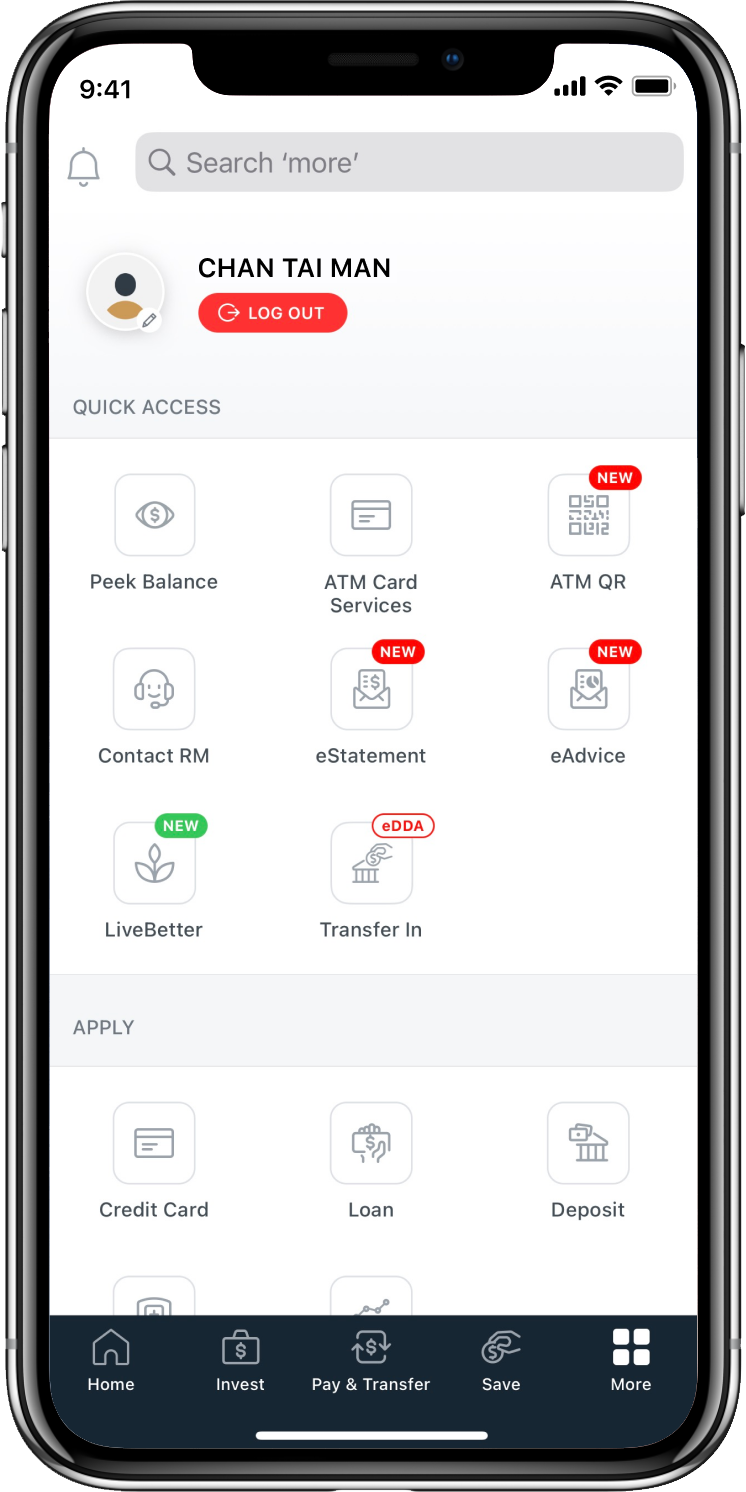

b: Post-log-in under the ‘More’ tab:

LiveBetter product icon under ‘Quick Access’

Invest Better

LiveBetter Funds help you identify all Securities and Futures Commission (SFC) authorised ESG funds 1 which incorporate environmental, social and governance (ESG) factors as their key investment focus and reflect them in their investment objective or strategy.

- "SFC-authorised ESG funds" refer to the Securities and Futures Commission ("SFC") list of authorised funds which incorporate environmental, social and governance ("ESG") factors as their key investment focus and reflect them in their investment objective or strategy pursuant to the SFC’s circular to management companies of SFC-authorised unit trusts and mutual funds – ESG funds dated 29 June 2021. In cases where the subject fund is SFC-authorized, SFC authorisation does not imply official recommendation and is not a recommendation or endorsement of a fund nor does it guarantee the commercial merits of a fund or its performance.

Step 1: Log in and go to “Invest” > “Funds”

Step 2: Scroll down and tap “LiveBetter Funds” section to view all LiveBetter Funds at a glance

Step 3: Tap the fund to view detailed information, including investment strategy, fund performance, etc.

HK Permanent ID Card Holder

DBS digibank HK allows you to open account(s) online anytime, anywhere. Both Multi-Currency Savings Account and Wealth Management Account can be opened in one go via DBS digibank HK.

You have an option to save and resume your application with your created User ID & password.

To open account(s) on DBS digibank HK, make sure you are:

- New to DBS or existing DBS Credit Card Customer

- Hong Kong Permanent Resident aged 18 or above

- Not a US Resident, US citizen or holding a US Permanent Resident Card (Green Card)

If you do not meet the above requirements to apply via the app, please make an appointment to open your account at our branch.

You need to get ready the following documents:

- Permanent Hong Kong Identity Card

- A Tax Declaration Form (if you are a tax resident of a country/jurisdiction other than Hong Kong)

- Certificate of Loss of Nationality of the US (if you were previously a US citizen, resident or Green Card holder)

If you wish to join DBS Treasures, you also need the following documents:

- Residential address proof issued within the last 3 months which bears your name. Examples of address proof are:

- A utility bill

- A statement issued by a regulated financial institution

- Mobile phone, internet service or pay TV statement.

- Employer’s Consent, if you are employed under a financial institution

You can upload the required document(s) in GIF, JPG, TIF, PDF files up to 5MB.

Yes, all information you provided (including but not limited to name, date of birth, address and HKID number, any photo images, videos or documents) and documents or any other information provided or obtained in the process of account opening with DBS Bank (Hong Kong) Limited will be encrypted throughout the transmission. Information collected with be used for account opening purposes only.

This helps us to validate your HKID and verify that you are the HKID card holder.

Here are some tips to capture the front and back of the HKID:

- Place your HKID on a light colour background, make sure the HKID number on the see-through window is clear and visible

- Place the whole HKID within the frame and tap the button according to the screen instruction

- Ensure the details captured are clear without any glare or shadow

Here are some tips to capture your selfie:

- Make sure the camera is level with your face and the selfie is taken against a plain background

- Avoid any accessories covering your face (e.g sunglasses, masks, hat, etc.)

- Sufficient lighting, avoid backlighting and direct sunlight

- Ensure no multiple faces in the picture

Your account will be activated after you make your first money deposit, which must come from an account in your own name. Below are the channels for deposit:

- Online transfer from another bank

- Transfer in via electronic direct debit authorisation (eDDA) from another bank

- Cheque (in your name) deposit or cash deposit at a DBS teller counter upon identity verification

It usually takes up to 1 working day for us to review your application. You will receive an email/SMS once your Wealth Management Account is open. You can transfer money from your Multi-Currency Savings Account to your Wealth Management Account to start investing.

The Bank reserves the right to request more information/documents from you, and/or invite you to visit one of our branches to complete the account opening process.Exit-entry Permit & PRC Resident Identity Card Holder

Online account opening via DBS digibank HK allows you to open account(s) anytime when you are in Hong Kong with GPS switched on in your device. Both Multi-Currency Savings Account and Wealth Management Account can be opened in one go via DBS digibank HK.

You have an option to save and resume your application with your created User ID & password.

If you would like to open a GBA Wealth Management Connect (Southbound) account, please refer to the “GBA Wealth Management Connect (Southbound)” FAQ section for more details.

To open account(s) on DBS digibank HK, make sure you are:

- New to DBS or existing DBS Credit Card Customer

- The People's Republic of China (“PRC”) resident aged 18 or above

- Holding a valid card format Exit-entry Permit for Travelling to and from Hong Kong and Macao (“Exit-entry Permit”)

- Holding a valid PRC Resident Identity Card

- Holding a valid Exit-Entry Report from the National Immigration Administration

- Physically located in Hong Kong during the account opening with GPS on in your device

If you do not meet the above requirements to apply via the app, please make an appointment to open your account at our branch in Hong Kong.

You will need the following:

- Exit-entry Permit in card format

- The PRC Resident Identity Card

- Translated residential address in English/Pinyin

- Exit-Entry Report from the National Immigration Administration (detailed instructions here)

- A Tax Declaration Form (if you are a tax resident of a country/jurisdiction other than Mainland China)

- Certificate of Loss of Nationality of the US (if you were previously a US citizen, resident or Green Card holder)

If you’d like to join DBS Treasures, you also need the following documents:

- Residential address proof which bears your name. Examples of address proof are:

- A government-issued driving license or The PRC Resident Identity Card

- A bank statement, issued by regulated banks in an FATF member country (including Mainland China) within the last 3 months

- A statement, issued by regulated financial institutions in Hong Kong within the last 3 months

- Employer’s Consent, if you are employed under a financial institution in Hong Kong

You can upload the required document(s) in GIF, JPG, TIF, PDF files up to 5MB.

Yes, all information you provided (including but not limited to name, date of birth, address and HKID number, any photo images, videos or documents) and documents or any other information provided or obtained in the process of account opening with DBS Bank (Hong Kong) Limited will be encrypted throughout the transmission. Information collected with be used for account opening purposes only.

This helps us to validate your Exit-entry Permit and PRC Resident Identity Card and verify that you are the card holder.

Here are some tips to capture your Exit-entry Permit and PRC Resident Identity Card:

- Make sure your card is placed flat (e.g. on a table) and clearly readable

- Ensure all edges of your card are inside the frame

- Ensure the details captured are clear without any glare or shadows

- Follow the instruction to capture both the front and the back of your Exit-entry Permit and PRC Resident Identity Card

Here are some tips to capture your selfie:

- Make sure the camera is level with your face

- Position yourself against a plain background

- Sufficient lighting, avoid backlighting

- Avoid direct sunlight

- Avoid wearing sun glasses, a hat or mask

- Camera needs to be focus

- Ensure only your face is in the picture

- Follow the on-screen instructions to complete the verification

This helps us to validate the decrypted information from your Exit-entry Permit and PRC Resident Identity Card. If you prefer not to enable the NFC or your device does not support the NFC, you can still continue with the online application. Upon the application submission, we will invite you to our branch in Hong Kong to complete the account opening process.

The Bank reserves the right to request more information/documents from you, and/or invite you to visit one of our branches to complete the account opening process.

Your account will be fully activated after you complete the Exit-Entry Report verification (detailed instructions here) and make the first money deposit, which must come from an account in your own name. Below are the channels for deposit:

- Online transfer from another Hong Kong local bank

- Transfer in via electronic direct debit authorisation (eDDA) from another bank

- Cheque (in your name) deposit or cash deposit at a DBS teller counter upon identity verification

If you are joining DBS Treasures, we will designate a DBS Treasures Relationship Manager (TRM) to manage your wealth. Once we’ve assigned the TRM to you, we will notify you the contact details of your TRM via SMS. Alternatively, you can check the contact details of your TRM by logging in to DBS iBanking or DBS digibank HK.

It usually takes up to 1 working day for us to review your application. You will receive an email/SMS once your Wealth Management Account is open. You can transfer money from your Multi-Currency Savings Account to your Wealth Management Account to start investing.

The Bank reserves the right to request more information/documents from you, and/or invite you to visit one of our branches to complete the account opening process.

Yes. With one Wealth Management Account, you can trade equities in Hong Kong, Singapore, U.S., Canada, Japan, Australia and United Kingdom. If you would like to trade in the U.S. and Canada markets, please complete and submit a W-8BEN form and Market Data Agreement form via DBS digibank HK or at any of our branches.

Get started

- Register through DBS digibank HK or DBS iBanking:

- Get ready your:

ATM card number and ATM PIN, or

Credit Card number and Card Expiry Date, or

Cashline Card number and Card Expiry Date - Go to DBS digibank HK or DBS iBanking login page and click "Register" to register for the service

Start using DBS digibank HK or DBS iBanking service as soon as your registration is completed

- Get ready your:

- Apply at a DBS branch:

- Complete the DBS iBanking Application Form and return it to any of our branches

- Please click the "Register" button on the DBS digibank HK or DBS iBanking login page on the next business day and then use the Initial Username or Secure Device^ to complete the activation procedure.

Important Note:

If you are a joint name account customer, please visit any of our branches and apply for DBS iBanking service.

You can retrieve your username via DBS digibank HK. Please click Forgot "Username" on the login page to retrieve username.

Get ready your:

- ATM Card number and ATM PIN, or

- Credit Card number and Card Expiry Date, or

- Cashline Card number and Card Expiry Date, or

- Secure Device

You may also contact our 24-hour Customer Service Hotline at (852) 2290 8888 or complete and return the DBS iBanking Service Request Form to any of our branches to retrieve your username.

You can reset your password via DBS digibank HK. Please click Forgot "Password" on the login page to reset it.

Get ready your:

- ATM Card number and ATM PIN, or

- Credit Card number and Card Expiry Date, or

- Cashline Card number and Card Expiry Date, or

- Secure Device

You may also complete and return the DBS iBanking Service Request Form to any of our branches to reset your password.

DBS digibank HK is a free service provided by our bank. Service charges will only be levied for designated services. For details, please refer to our Bank Charges Schedule.

However, your telecommunications service providers may impose data charges. Please check with your service providers for details.

All you need is any Apple iPhone with iOS 12.0 or higher, or an Android device running Android 7.0 or higher. Simply download DBS digibank HK from Apple App Store, Google Play Store or Huawei App Gallery.

We recommend you use a mobile device with a 64-bit processor. Please note DBS digibank HK is not optimised for usage on tablets.

From September/Q4 2024, customers with China-purchased Huawei devices* will receive prompts for HarmonyOS Next firmware updates by model batch. Due to compatibility issues, in which HarmonyOS Next (version 5.0 or above) will only support the native Harmony apps, DBS digibank HK app will stop working on those devices once updated to HarmonyOS Next.

We recommend you continue enjoying the best-in-class digital banking service via DBS iBanking or DBS digibank HK on iOS or Android devices. For customers who have set up digital token in your China-purchased Huawei device, please click here for the authentication workaround of high-risk transactions or contact your Relationship Manager or our Customer Service Hotline at +852 2290 8888 for assistance.

*This also applies to users who purchased Huawei devices in China and brought them out of China.

You are recommended to i) set up your digital token on other IOS or Android devices with the details here or ii) follow the steps below to request a hard token for authentication of high-risk transactions. For assistance, please contact our Customer Service Hotline at +852 2290 8888.

Step 1: Pass the login authentication

- Log in to DBS iBanking> Click “Authenticate Now” > “Generate Secure PIN” > “SMS” > Enter the 6-digit OTP received on your mobile phone > Click “Authenticate”.Step 2: Manage Your digital token

- Go to the “Request” section in the homepage > Click “Manage Digital Token” > “Deactivate” > Click “Continue” in the confirmation prompt.

Step 3: Request the hard token

- Go to the Next Step section in the Manage Digital Token Page > Click “Request Secure Device” > “New Request” for customers with no hard token request, or Click “Replacement” and select the replacement reason for customers with hard token previously > Click “Next” > “Submit” after verifying the request details > Completion page.

*This also applies to users who purchased Huawei devices in China and brought them out of China.

To set up Digital Token, please follow these steps:

Step 1: Download and log in to DBS digibank HK

Step 2. Tap ‘More’ and select ‘Manage Digital Token’

Step 3. Click ‘Set Up Now’

Step 4. Enter the 6-digit email OTP sent to your registered email address

Step 5. Enter the 6-digit SMS OTP sent to your registered mobile number.

Please click here to find out more about the Digital Token.

Please click here to find out more about the Digital Token.

You can access DBS digibank HK wherever your mobile device connects to the Internet. Please be reminded that data roaming charges may apply. For details, please contact your telecommunication service providers.

DBS Treasures, DBS Treasures Private Client and DBS Private Banking clients can enjoy the following 5 innovations at DBS digibank HK:

- Trade in 7 international equity markets* and FX 24x71

- Get the full picture with the Dashboard in complete clarity

- Portfolio Overview and Analysis*

- A comprehensive range of Customised Price Alerts and Investment-related Notifications

- Research and Proprietary Insights

In addition to the improved layout with more intuitive navigation, our DBS digibank HK comes with these exciting features:

- Peek Balance: Check your balance in one swipe. No login required!

- Fingerprint Login: Log in to your account securely with just your fingerprint.

- Single-view Dashboard: We're sparing you the hassle – you can now view all your accounts in a single dashboard!

- Quicklinks: Access your frequently-used services with the new drag and drop quick links function.

- Personalized Profile: Customize your own profile with a picture or nickname.

- Payee List: View all your payees right from the dashboard page and manage them on the go.

Plus, you can continue to enjoy these key services:

- Check account balances, Wealth Management Investment Portfolio*, and Transaction History

- Transfer funds to self-named accounts within DBS

- Transfer funds to registered or non-registered accounts in DBS or other local banks

- Pay bills

- Trade local securities

- Open time deposit account and change time deposit maturity instruction

- View e-Coupon

*For DBS Private Bank, DBS Treasures Private Client and DBS Treasures customers with Wealth Management Investment Portfolio

1Foreign Exchange can be conducted 24x7 in Wealth Management Accounts and from 00:00-23:30 in Multi-Currency Savings Accounts. Cross currency transactions between a Wealth Management Account and a Multi-Currency Account are accepted within the service hours of 09:00-21:00, Monday to Friday. For more details, please refer to www.dbs.com.hk/ibanking/ft-time1.html.

Two-factor Authentication

- Enter your username and password

- If you have set up the Digital Token on your device, you can log in to DBS digibank HK seamlessly

- If you have not set up the Digital Token on your device, you need to log in to DBS digibank HK using SMS OTP or your Secure Device

- To log in according to step 3, please enter the One Time Password sent to you via SMS or the Secure Device PIN to complete two-factor authenticate.

- Enter your username and password

- Choose to authenticate using the Digital Token, an SMS OTP or the Secure Device:

- If you log in using the Digital token, open your DBS digibank HK and tap “Digital Token” next to the “Log In” Review before you tap “Approve”

- If you log in using an SMS OTP, enter the 6-digit SMS OTP sent to your registered mobile number

- If you log in using your Secure Device, press and hold the button on the Secure Device to generate a 6-digit Secure PIN. Please click here for more details.

One Time Password

An OTP is a security feature in DBS digibank HK, a password sent by us to your registered mobile phone number via Short Message Service (SMS). An OTP is required when you perform designated transactions through DBS digibank HK.

Important Note:

The SMS will not be forwarded to any other mobile phone numbers, even if you have signed up for SMS forwarding with a Hong Kong telecommunication service provider.

With the implementation of the Secure Device, depending on the services you need, you are required to use SMS OTPs and/or the Secure Device to authenticate your transactions.

Please click here for more information.

You may follow these steps:

- Register online:

- You would need to register your mobile phone number for receiving OTPs when you register for DBS digibank HK

- An SMS OTP will be sent to your registered mobile phone number. You will be required to enter the SMS OTP for verification. Alternatively, if you are a DBS account customer and update your mobile phone number, we will send you a Security Code by registered mail to verify the mobile phone number

- Once you have received the Security Code, simply log in to DBS iBanking and enter the code to complete the mobile phone number registration

- Register at a DBS ATM: (not applicable to customers with DBS credit cards and/or Cashline cards only)

- Insert your DBS ATM card and enter your ATM PIN.

- Choose "Donation / Other" and then "OTP Registration / Update".

- Enter the mobile phone number you want to use to receive OTPs.

If your ATM card is a joint-name ATM card, please complete the DBS iBanking Application Form and return it to any of our branches. - Register at a DBS branch:

complete the DBS iBanking Application Form and return it to any of our branches to register your number.

The OTP expires 100 seconds after it is issued. If you are not able to enter the OTP and log on to DBS digibank HK before it expires, you can click on "Request a new OTP" on the OTP input page.

If you are not able to confirm the transaction before the OTP expires, you can request a new OTP at the OTP authorisation page, and then enter the new OTP to confirm that transaction again.

Secure Device

The Secure Device, on top of the current SMS One Time Password ("SMS OTP"), is implemented as an additional gateway to enhance internet and mobile banking security.

It is designed for tightening the authentication process. For certain internet and mobile banking transactions that require a higher level of authentication, security clearance is further enhanced with the simultaneous use of SMS OTP and Secure Device.

Please click here to find out the mode of authentication required for various types of banking services.

If you are an existing DBS iBanking customer, you may request for a Secure Device through DBS iBanking (just click on "Request", then "New Secure Device") or at any of our branches in Hong Kong.

It is free of charge for first time applications for the Secure Device and for replacements due to out of battery. In case of loss, theft or malfunctioning of the Secure Device, a fee of HK$100 will be charged for a replacement of the Secure Device.

If you do not activate the Secure Device, you will not be allowed to perform certain transactions on DBS digibank HK. You can log in to DBS digibank HK, go to “More” > “Activate Secure Device” and activate the Secure Device anytime.

Peek Balance

Peek Balance lets you check your preferred account balance with a simple swipe on your smartphone or Apple Watch. No login required! You can select your preferred account from your DBS deposit or credit card accounts.

Yes, you have a choice. Peek Balance requires a one-time setup after you log in to DBS digibank HK, under “Peek Balance” in “More” tab . Without performing this setup, Peek Balance will not be turned on.

Fingerprint or Face ID Login

Your fingerprint is your password. With fingerprint login, accessing your accounts is faster, easier and more secure.

Fingerprint login is available on Touch ID enabled Apple smartphone running on iOS 12.0 or higher and fingerprint enabled and designated Android smartphone operating on v7.0 or higher.

We recommend you use a mobile device with a 64-bit processor. Please note DBS digibank HK is not optimised for usage on tablets.

For technical support of Apple iPhone Touch ID, please refer to Apple’s article If Touch ID isn't working on your iPhone or iPad.

For technical support of Android Fingerprint Login, please refer to the website of the relevant Android Smartphone Brand.

Yes. You can enable Face ID under Personalization Settings in DBS digibank on iPhone X or later.

To use Face ID in DBS digibank, you will need to turn on Face ID for digibank in your iOS Settings.

We will provide app updates to support the latest models of mobile devices from time to time. You are advised to update the DBS digibank app once available for best experience.

For features and usage of Face ID, please refer to Apple’s article About Face ID advanced technology.

If you have not performed the one-time setup on your new iPhone X or later to enable Face ID, you will not be able to use Face ID and you can continue using your username and password to log in-to DBS digibank HK. If you have performed the one-time setup to enable Face ID, you can always turn it off under “Face ID” in “More” tab.

Account Overview

You can check the account balance and transaction history of the following types of account:

- Investment

- Investment Fund Account

- Securities Account

- Investment ID Account

- Deposits

- Current Account

- Savings Account

- Save & Cheque Account

- Multi-currency Savings Account

- Renminbi Savings Account

- New Generation Easy Saver Plan

- Time Deposit Account

- Credit Card

- Loans

- Cashline Revolving Loan Account

- Personal Instalment Loan

- Salaries Tax Loan

- Home Loan Account

- Portfolios

Dormant Account Temporary Reactivation

This will re-enable some selected accounts' capability for both credit and debit transactions temporarily until HKT 11.59 pm on the day of reactivation; and facilitate customer to perform a transaction for a full reactivation.

- Only the following CASA accounts can be reactivated temporarily in DBS digbank HK:

- Current Account

- HKD Savings Account

- Save and Cheque Account

- Multi-Currency Saving Account; and

- At least one of the CASA accounts above is active.

For Current Account, HKD Savings Account, and Save and Cheque Account:

- Go to Home Page on DBS digbank HK

- Select and click the dormant account for reactivation

- Click Start Verification in banner under account detail page

- Perform Two-factor authentication

- Tap Next after Verification is completed

- Tap I Accept after reading and agreeing to the Declaration and Agreement

- Confirmation page regarding successful temporary reactivation of the account (you'll be logged out)

For Multi-Currency Savings Account:

- Go to Home Page on DBS digbank HK

- Select and click the Multi-Currency Savings Account

- Select dormant currency child account for reactivation

- Click Start Verification in banner under account detail page

- Perform Two-factor authentication

- Tap Next after Verification is completed

- Tap I Accept after reading and agreeing to the Declaration and Agreement

- Confirmation page regarding successful temporary reactivation of the account (you'll be logged out)

In general, an account may become dormant when there is no customer-initiated transaction* over an extended period of time, normally 12 consecutive months.

*Customer-initiated transaction includes credit or debit transaction from all channels, such as ATM, iBanking, DBS digibank HK, Phone Banking, FPS, over-the-counter, and FX transaction, etc. and cash withdrawal over-the-counter.

Transfer Funds

Pay Bills

Online Fund Investment

Frequently asked questions about investing fund online

Frequently asked questions about investing fund online

An investment fund is also known as a unit trust or mutual fund, which pools together the resources from individual investors and is managed by professional fund managers. Investors can choose from an array of funds which invest in equities, bonds, currencies and derivatives, etc.

If you have a Wealth Management Account (WMA), you can conduct online fund subscription through DBS iBanking or DBS digibank HK app.

Have not got a WMA? Please open an account with us now:

For DBS Account/DBS Treasures customers, please do so via one of our branches or DBS iBanking. You can also visit the following link for more information: https://www.dbs.com.hk/personal/support/invest-new-to-wma.html

For DBS Treasures Private Client/DBS Private Bank clients*, please visit https://www.dbs.com.hk/treasures-private-client/dbs-forms/contact-me-wealth.page and our Relationship Managers will reach out to you shortly.

*In Hong Kong, DBS Private Bank is the private banking division of DBS Bank (Hong Kong) Limited.

You can subscribe funds (both in lumpsum & Regular Fund Investment Plan), redeem and switch investment funds distributed by DBS via DBS digibank HK app.

For DBS iBanking, you can subscribe funds in lumpsum and redeem funds.

DBS is offering a wide range of investment funds covering Equity Funds, Fixed Income Funds, Balanced Funds and Alternative Funds for your selection.

Yes. You may put through your instruction anytime. However, the order will be processed in accordance with the cut off time of the fund prescribed by the Bank. Any order received by the Bank after the cut off time will be processed on the next business day.

For lumpsum fund subscription/switching/redemption via DBS iBanking or DBS digibank HK app, the cut off time is 3pm Hong Kong Time and may be subject to change from time to time without prior notice.

In relation to Regular Fund Investment Plan, for a newly created order, the earliest start date of a plan you can select is the next calendar day, except 29th, 30th and 31st of each month.

For lumpsum fund subscription, HK$5,000 or its equivalent in foreign currency.

For Regular Fund Investment Plan (RFIP), HK$1,000 or its equivalent in foreign currency in each investment cycle.

You can search for funds by fund name, fund code or International Securities Identification Number (ISIN) through the search bar on DBS digibank HK app or DBS iBanking. You can also filter funds by asset class, sector, geography, DBS product risk rating, etc.

For lumpsum fund subscription/switching/redemption:

Once you have submitted the order instruction, you cannot amend or cancel the order online. You may, however, effect an amendment or cancellation by:

For DBS Account / DBS Treasures customers - visiting any of our branches for processing.

For DBS Treasures Private Client and DBS Private Bank* clients - contacting your Relationship Manager.

For Regular Fund Investment Plan:

You can terminate your plan via DBS digibank HK app.

*In Hong Kong, DBS Private Bank is the private banking division of DBS Bank (Hong Kong) Limited.

You can refer to the subscription/switching fee displayed on the order input page. The respective fee will be deducted from your subscription/switching amount.

Currently, there is no fee for fund redemption. However, this is subject to future changes. For details, please refer to the display on the order input page.

The settlement period might vary for different fund houses, and you may visit the Order Status page to keep track of your orders:

- Log in to DBS digibank HK app

- Tap on <Invest> on bottom navigation bar

- Tap on <Funds> and select <Order Status> on the sub-menu

Note: Switching is only available via DBS digibank HK

No, not all fund holdings are switchable. You can refer to the trade options available by tapping on the <TRADE> button below your fund holding. <Switch> options will be available if your fund holdings are switchable.

We only allow switching within the same fund house currently. You can select the fund holding you wish to switch out from and tap <Select Fund> to explore the list of funds that you can switch in.

Note: Switching is only available via DBS digibank HK

Each fund requires a minimum number of units to switch, and it is stated on the order input page. The maximum number of units you can switch is your full fund holding units.

You can choose to invest with an investment frequency below:

- Once a week

- Every 2 weeks

- Once a month

- Every 2 months

- Every 3 months

The earliest start date you can select is the next calendar day upon plan setup, up to one month from the setup day. However, 29th, 30th and 31st of each month are not available for selection.

For end date, the longest end date you can select is up to 5 years from the start date.

When conducting fund subscription / switching transactions in Wealth Management Account via DBS iBanking or DBS digibank HK app, DBS will conduct a suitability assessment on DBS Account / DBS Treasures customer and on the investment fund. Therefore, a customer must have a valid Financial Need Analysis. Apart from visiting our Branch or contacting your Relationship Manager, a customer can also complete/update Financial Need Analysis via DBS iBanking and DBS digibank HK app.

In addition, a customer must also have a valid result from the Vulnerable Customer Assessment. If the customer is deemed to be a vulnerable customer, we will decide whether or not to arrange a Relationship Manager to assist the customer in conducting an investment transaction to ensure the customer clearly understands the product features and risks.

To complete a Vulnerable Customer Assessment, please visit one of our branches or call our Customer Service Hotline at 2290 8304 (9:00 am - 6:00 pm on Monday to Friday, 9:00 am - 1:00 pm on Saturday, except public holidays) to arrange.

Suitability assessment is a process matching the investment product with the client’s personal circumstances and risk tolerance.

DBS conducts suitability assessments before an investment transaction, based on the customer’s risk tolerance level, investment objectives, investment period, investment experience, and asset concentration.

Should there be any mismatch in the suitability assessment (e.g. product risk rating is higher than customer’s risk tolerance level), a customer may be required to conduct the investment transaction with his/her Relationship Manager to ensure the customer clearly understands the product features and risks.

You can now conduct fund transactions under your Wealth Management Account (WMA), through our DBS iBanking or DBS digibank HK app.

Have not got a WMA? Please open an account with us now:

For DBS Treasures customers, please visit one of our branches or visit our DBS iBanking. You can also visit the following link for more information: https://www.dbs.com.hk/personal/support/invest-new-to-wma.html

For DBS Treasures Private Client and DBS Private Bank clients*, please visit https://www.dbs.com.hk/treasures-private-client/dbs-forms/contact-me-wealth.page and our Relationship Managers will reach out to you shortly.

For DBS Account customers, you can still place orders at any of our branches or call our Customer Service Hotline at (852) 2290 8888 (press 3 after language selection) for enquiries. You may also consider upgrading to become a DBS Treasures client /DBS Treasures Private Client and opening a Wealth Management Account to enjoy more comprehensive online banking services.

*In Hong Kong, DBS Private Bank is the private banking division of DBS Bank (Hong Kong) Limited.

For DBS Account / DBS Treasures customers, you can still place orders at any of our branches or call our Customer Service Hotline at (852) 2290 8888 (press 3 after language selection) for enquiries.

For DBS Treasures Private Client and DBS Private Bank* clients, please contact your Relationship Manager.

*In Hong Kong, DBS Private Bank is the private banking division of DBS Bank (Hong Kong) Limited.

Investment Account Management (IAM) : Exclusive for Wealth Management Account

The IAM page contains forms and agreements related to trading eligibility including Financial Needs Analysis (FNA), Hong Kong Investor Identification Regime (HKIDR), U.S. and Canada Market Data Agreements, and the W-8Ben Form.

You can access the IAM page by clicking on the DBS digibank HK app <Invest> tab and scrolling down to the bottom banner.Financial Needs Analysis

You can visit the following website to get more information about the FNA and product risk rating.

For Wealth Management Account users:

https://www.dbs.com.hk/treasures/investments/fna

For other users:

https://www.dbs.com.hk/personal/investments/fna

For Wealth Management Account users:

On DBS digibank HK, please visit the IAM page, then update FNA by tapping <Access Now> or <Update> on <Finance Need Analysis>.

For other users:

On DBS digibank HK, please visit the <Invest>, then update FNA by tapping <Access Now> or <Update> on <Finance Need Analysis>.

For all users:

On DBS iBanking, please navigate to <Banking> on the top menu bar, then click on <Invest> and select <Conduct Financial Need Analysis>.Virtual Asset Knowledge Test

The Virtual Asset Knowledge Test is a requirement introduced by the regulator to ensure client possess knowledge and understanding the nature and key risks of virtual assets and virtual assets-related products before conducting trade of virtual assets-related products. The test is designed to assess an individual's understanding of virtual assets-related products and the risks involved in trading them.

For DBS Treasures Clients, please visit <Invest> and tap <Investment Account Management>, then complete the Virtual Asset Knowledge Training and Assessment by tapping <Access Now>.

Please read the training material about virtual assets and virtual assets-related product. You may start to conduct the assessment after reading the training material.

For DBS Treasures Private Clients / DBS Private Banking Clients, the Virtual Asset Knowledge Test is integrated with your Investment Knowledge & Experience assessment. Please visit the <Investment Account Management> under <Invest>, then tap <Update> underneath <Investment Knowledge & Experience>.

Can I retrieve my Virtual Asset Knowledge Test result after I submit it?

Trade Securities

The following functions are available:

- Place Order

- View Current Holdings

- Order Status

- Transaction History

- Market Information

You can place "Enhanced Limit Order", "Market Order", "At-auction Limit Order", or “Stop Loss Order” (applicable for Securities Account only) via DBS digibank HK app or DBS iBanking.

After you have entered and confirmed your instruction, a reference number will be provided. This only acknowledges the Bank's receipt of your instruction. There is no guarantee that your instruction will be processed or executed in the market. Your instruction may be rejected or may not be executed due to fluctuations in stock price, insufficient market liquidity, system delayed/failure or any other event beyond the control of the Bank. You can check the status of your instruction under “Order Status” via DBS digibank HK app or DBS iBanking.

As the initial order remains queuing in the market pending processing, notwithstanding subsequent placement of an amendment order or cancellation order, such amendment order or cancellation order may not be transacted or processed. You are advised to check your order status under “Order Status” via DBS digibank HK app or DBS iBanking.

For customers of DBS Private Bank and DBS Treasures Private Clients, please refer to our Fee Schedule here.

DBS Online Equity Trading Platform is a new DBS online platform on DBS digibank HK app and DBS iBanking. It is offered to DBS Private Bank, DBS Treasures Private Clients and DBS Treasures Wealth Management Account customers.

For other customers, you can trade securities in Hong Kong market with a Securities Account through channels such as DBS digibank HK app / DBS iBanking .

With DBS Online Equity Trading Platform, you are able to trade in seven major markets of Hong Kong, Singapore, United States of America, Canada, Japan, Australia and the United Kingdom. You can access the trading platform via DBS digibank HK app / DBS iBanking anytime anywhere to view your portfolio and place trades in any of the seven major markets. You can choose the eligible portfolios displayed to be the designated account for your online purchase and sale of equities through the Bank. Equities traded through DBS Online Equity Trading Platform will be treated as part of your assets under management with the Bank.

For more information, please click here.

For more information about trading on DBS Online Equity Trading Platform, please click here.

For any enquiries related to eIPO, please click here.

Time Deposit

You can change the maturity instruction of your time deposit through the function of " Change Maturity Instructions " under Place Time Deposit in DBS digibank HK. Change of maturity instruction through DBS digibank HK will only be accepted if the instruction is given at least 1 business day before the maturity date. If you would like to change the maturity instruction on the maturity date, please visit any of our branches for further enquiry.

GBA Wealth Management Connect (Southbound)

- Southbound Wealth Management Connect allows qualified GBA mainland investors to invest in selected eligible wealth management products sold by banks in Hong Kong through designated channels.

- Customers first need to set up a bank account with cross-border remittance function with the partner bank in the Mainland designated by the Bank in Hong Kong ("Mainland Remittance Account"), and the Customers also need to open a GBA Wealth Management Connect Southbound Account (“Southbound Account”) with investment function in the Bank in Hong Kong and bind it to the corresponding Mainland Remittance Account to form a "one-to-one" pairing.

- Customers can remit to the Southbound Account in Hong Kong through the Mainland Remittance Account and purchase qualified wealth management products sold by the Bank in Hong Kong through the Southbound Account.

Mainland investors should meet all the requirements set by both the Mainland and Hong Kong regulatory authorities, including

- Investment in single name account;

- Have full capacity for civil conduct;

- Being residents registered in the 9 GBA cities, or with record of social security contribution or individual income tax payment in the 9 GBA cities for 5 consecutive years;

- With 2 or more years of investment experience and net month-end household financial assets of RMB 1 million or more over the past 3 months, or month-end household financial assets of RMB 2 million or more over the past 3 months;

- As assessed by the Bank of Hong Kong as not belonging to a vulnerable customer.

All the account opening is subject to the Bank’s approval. Further information is available on the website of the Hong Kong Monetary Authority.

Mainland investors should complete the account opening procedure by attestation through a partner bank in Mainland, or open the account through a bank in Hong Kong in person.

Yes, they can. But mainland investors must provide the Mainland Remittance Account number for the Bank in Hong Kong to complete the pairing before activating the Southbound Account.

- The cross-boundary capital flows in Wealth Management Connect will be subject to the total and individual investor quota management, and will be conducted and managed in a closed-loop system by bundling the Mainland Remittance Account and Southbound Account to ensure that the relevant funds will only be used to invest in eligible investment products. Thus, customers can only use the Mainland Remittance Account bound in the Mainland to make cross-border remittances, collection and receive investment returns under Southbound Connect.

- The funds in the Southbound Account can only be used to purchase eligible wealth management products and for outward remittance to the Mainland Remittance Account.

- Customers are not allowed to transfer funds from the Southbound Account to any accounts (including non-Hong Kong accounts) other than the Mainland Remittance Account.

- Customers are not allowed to withdraw cash from the Southbound Account or use the asset(s) in the Southbound Account for pledge, leverage, guarantee and other purposes.

- Southbound Account can only receive funds from the Mainland Remittance Account in RMB, and remit funds back to the Mainland Remittance Account in RMB. Regardless of the settlement currency of the eligible wealth management products invested by the customer, when the investment is withdrawn and the funds are remitted back to the Mainland Remittance Account, the funds must be converted back to RMB.

- All cross-border remittances between the Mainland Remittance Account and the Southbound Account must be in RMB, which means the Mainland Remittance Account of our Mainland partner bank can only send or accept RMB funds.

- The Bank in Hong Kong will provide customers with foreign exchange services to purchase eligible wealth management products denominated in Hong Kong dollars and foreign currencies. Customer can also directly invest in eligible wealth management products denominated in RMB in the Southbound Account.

Each eligible Southbound investor can only open one Mainland Remittance Account and one Southbound Account at any time.

- The individual investor quota is calculated on a net basis. The accumulated net remittance amount of the customer to the Southbound Account through the Mainland Remittance Account shall not exceed the individual investor quota at any time.

- The Individual investor quota for each eligible investor is RMB 1 million.

- The usage of the individual investor quota under Southbound Connect is calculated as follows:

Usage of individual investor quota under Southbound Connect =

cumulative remittances from the Mainland to Hong Kong and Macao under Southbound Connect – cumulative remittances from Hong Kong and Macao back to the Mainland under Southbound Connect - Example 1:

If a customer first remits RMB 500,000 from the Mainland to Hong Kong, then remits RMB 100,000 from Hong Kong to the Mainland, Individual investor quota usage is RMB 400,000 and the Available Quota is RMB 600,000. - Example 2:

If a customer first remits RMB 500,000 from the Mainland to Hong Kong, then remits RMB 600,000 investment return from Hong Kong to the Mainland, the individual investor quota usage is RMB -100,000 and the available quota is RMB 1,100,000. - Subject to the aggregate quota in Q8, if the net transfer of funds into the Southbound Account exceeds the individual investor quota limit, the Bank in Hong Kong will refuse to receive the funds and notify the mainland partner bank to return the bulk remittance to the Mainland Remittance Account.

- In addition, the use of individual investor quota is also affected by the aggregate quota, please refer to Aggregate quota.

The individual investor quota is subject to changes by regulatory authorities from time to time.

Aggregate quota is the total amount of funds that is allowed to be remitted from the Mainland to Hong Kong and Macao under Southbound Connect. The aggregate quota is calculated on a net basis. The cumulative net remittance from the Mainland under Southbound Connect should not, at any time, exceed the aggregate quota.

- The aggregate quota for the Southbound Scheme is initially set at RMB 150 billion.

- Customers should pay attention to the possible impact of the limit on the total amount and related risks. For example, the Bank in Hong Kong may suspend processing of a customer's Southbound - related remittance instructions from the Mainland to Hong Kong due to the total amount being used up. Remittances returned to the Mainland and investment instructions that have been submitted to the Southbound Account will not be affected.

- The aggregate quota is subject to changes by the regulatory authorities from time to time.

Wealth management products under Southbound Connect include

- Investment products (excluding products listed and traded on the Hong Kong Exchanges and Clearing Limited)

The following products, which are assessed as “non-complex” and “low” risk to “medium” risk by Hong Kong banks distributing such products:

(1) funds domiciled in Hong Kong and authorised by the Securities and Futures Commission; and

(2) bonds - Deposits

RMB, HKD and foreign currency deposits namely US dollar, Euro, UK Pound Sterling, Australian dollar, New Zealand dollar, Canadian dollar, Swiss Franc, Japanese Yen and Singapore dollar

Suspend or cancel DBS iBanking / DBS digibank HK service

If you want to suspend DBS iBanking / DBS digibank HK service, please visit our branch or contact our Customer Service Hotline at 2290 8888 for assistance.

You are advised to save or print a copy of your eStatements. You will not be able to retrieve the eStatements once your DBS iBanking / DBS digibank HK service is successfully suspended.

If you want to cancel DBS iBanking / DBS digibank HK service, please visit our branch for assistance.

You are advised to save or print a copy of your eStatements. You will not be able to retrieve the eStatements once your DBS iBanking / DBS digibank HK service is successfully cancelled.

If you want to cancel your DBS Bank account, please visit our branch for assistance.

Bank Account Closure

If you want to close your DBS bank account, please submit your online request via this link go.dbs.com/hk-close-en and we will contact you within 2 working day to handle your request.

You are advised to save or print a copy of your eStatements. You will not be able to retrieve the eStatements once your DBS iBanking / DBS digibank HK service is ceased after all accounts closed.

Please make appropriate arrangement for any regular payments or receipts made through the account, such as Standing Instruction (SI), Direct Debit Authorization (DDA), autopay, etc.

Open Banking

Open Banking allows information to be shared with TSPs (Third-party Service Providers) via API (Application Program Interface). HKMA promotes Open Banking to facilitate innovation and enhance customer experience. API is a computer programming approach that bridges between the bank and TSPs to provide more well-rounded services to our customers. Our TSP partners are registered through our partnership onboarding governance process and are continuously monitored to ensure your personal information is secured.

For more information, please click here.

Quick Links

Others

Need help?

- Help & Support Portal

- Contact Us

- General Banking Enquiry Customer Service Hotline :

(852) 2290 8888