Understanding Credit Card Statement

Learn how to interpret the different components of your credit card statement.

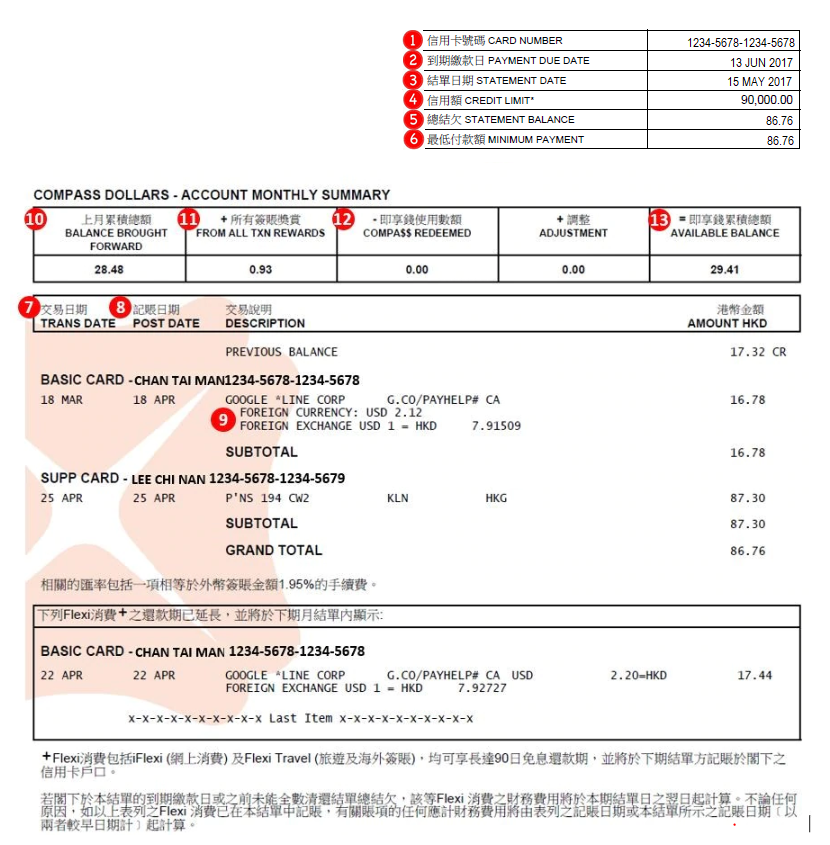

Here is a sample of your Credit Card Statement

1. Card Number: Credit card number.

2. Payment Due Date: If the full / minimum payment amount is not paid for by the due date indicated, late fee will be charged accordingly. Payment due date will be reflected as “Immediate” if no minimum payment was made for the previous statement.

3. Statement Date: Statement date will recur on the same day of every month, and all of your posted transactions spent on last 30 or 31 calendar days since from last statement date would display on this statement.

4. Credit Limit: This indicates the combined credit limit share amongst all the cards you own including supplementary credit card(s).

5. Statement Balance: The total outstanding balance of your credit card dated on your statement date. If there is “CR” sign in front of the amount, which means your credit card remain credit balance as of statement date.

6. Minimum Payment: Minimum payment indicates the smallest amount payable before the due date. If you don’t settle the minimum payment of your credit card statement, financial charge will be charged accordingly in daily basis.

How is my Minimum Payment amount calculated?

If the total outstanding balance is HK$300 or above, the minimum payment will be the sum of the followings:

All charges, fees, costs, expenses, interests and/or finance charges posted to the current statement of card Account;

Any amount in excess of the credit limit incurred after last statement date; and

1% of the statement balance excluding all charges, fees, costs, expenses, interests and/or finance charges posted to the Card Account,

Or HK$300, whichever is higher plus any outstanding minimum payment.

If the total outstanding balance is less than HK$300, the minimum payment will be the total outstanding balance.

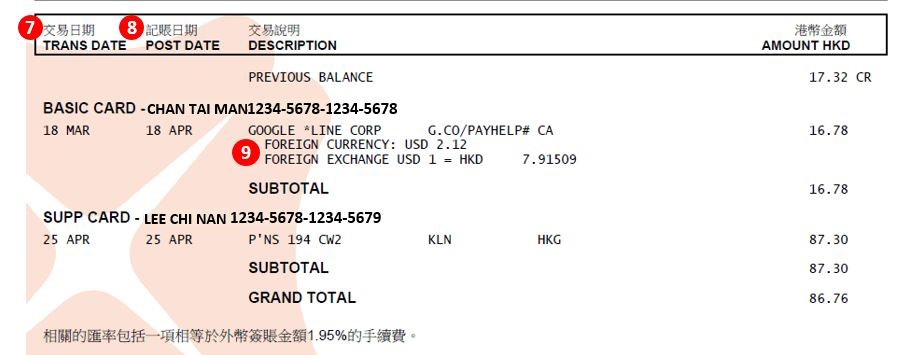

7. Transaction Date: The date you physically used your credit card spending at related merchant.

8. Post Date: The date which VISA / Mastercard / American Express process the transaction settlement and billed on your credit card.

9. Overseas Transaction: VISA / Mastercard / American Express applicable exchange rate on processing date plus 1.95%.

1) Compass Dollars:

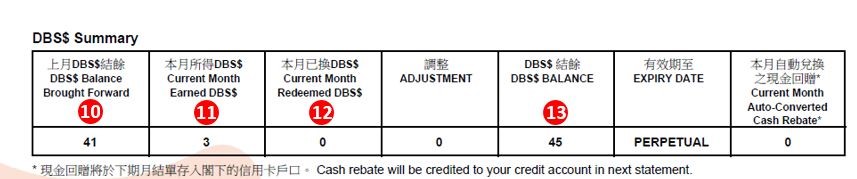

2) DBS$:

10. DBS$ / COMPASS Dollar Balance Brought Forward: Total DBS$ / COMPASS Dollar available from your previous statement.

11. Current Month Earned DBS$ / COMPASS Dollar: Total DBS$ / COMPASS Dollar earned from current statement.

12. Current Month Redeemed DBS$ / COMPASS Dollar: Total DBS$ / COMPASS Dollar you have redeemed from current statement.

13. DBS$ / COMPASS Dollar Balance: Total available DBS$ / COMPASS Dollar of your credit cards (including supplementary credit cards) as of statement date.

To borrow or not to borrow? Borrow only if you can repay !

Related Information

We Welcome your Feedback

Need more help?

Contact support and we'll try to resolve your issue quickly.

Contact Customer Support