Transfer money to overseas bank account

You can transfer money to overseas bank account through below channels.

Log in and tap “Pay & Transfer”, then select “Overseas Transfer Funds”

Select existing recipient or add registered new recipient

Enter transaction details

Verify details and submit *

* Subject to your security settings, authentication with a Digital Token may be needed in step 4. You can activate your Digital Token immediately via DBS digibank HK app. Please click here for details.

If you have never used Online Remittance Service, please increase your overseas transfer limit via DBS iBanking.

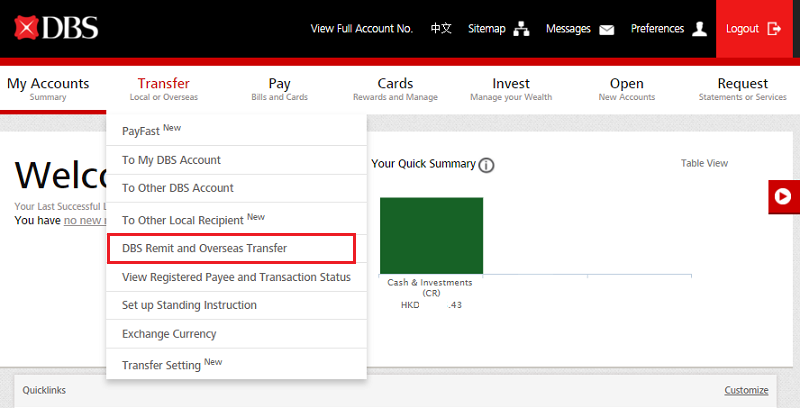

Log into DBS iBanking

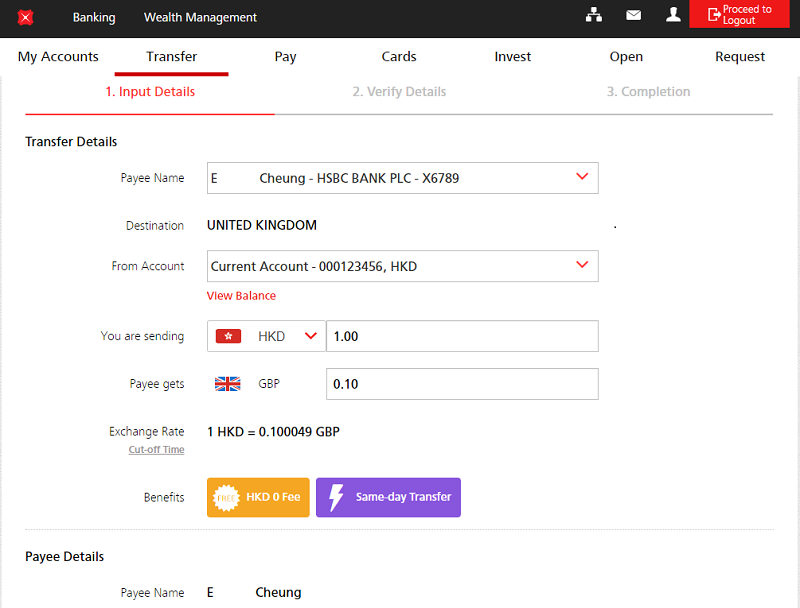

Select “Transfer” at the top menu, and then “DBS Remit and Overseas Transfer”

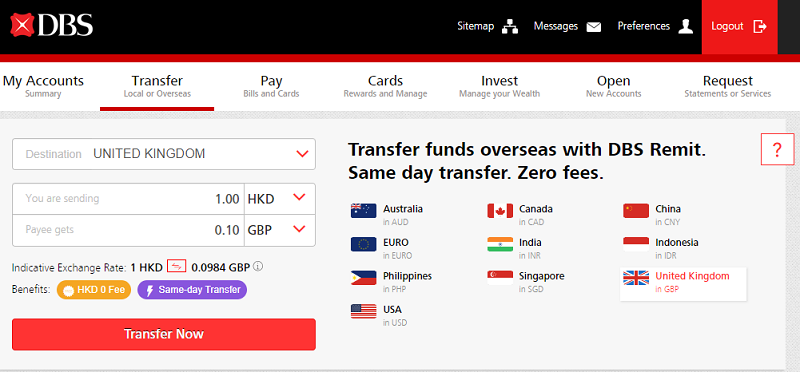

Select “Destination” from the pull-down menu or click on the country on the right hand side. Then enter details for “You are sending” or “Payee gets”, and click “Transfer Now”

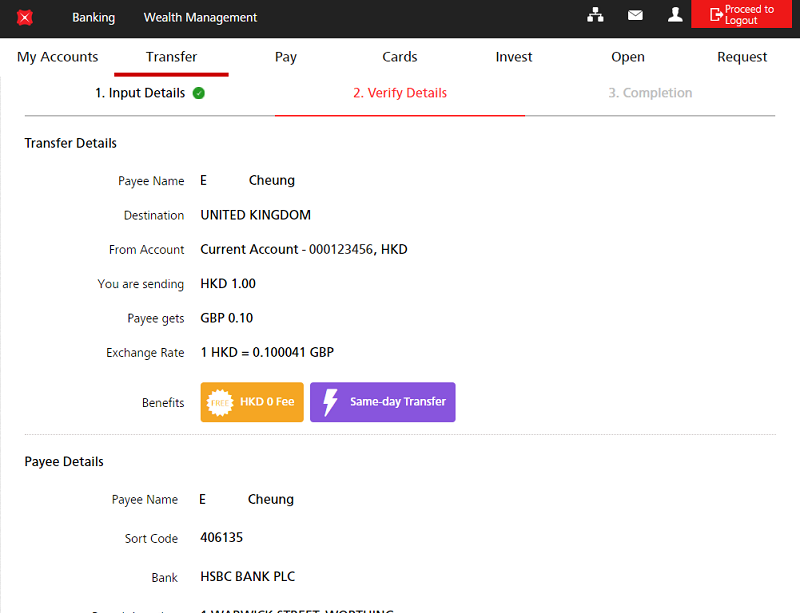

Enter “Transfer Details” and “Payee Details”

Verify details and submit transaction

You can go to our branches to request money transfer directly

Remarks:

Your daily limit for overseas funds transfer is HK$3,000,000 (combined limit of all overseas funds transfer, including DBS Remit).

DBS Remit same-day transfers are only applicable on clearing days (“Clearing day” means Mondays to Fridays, except public holidays in Hong Kong) within the respective cut-off times of each destination. Applications can be submitted 24/7 but those outside the cut-off times, non-clearing day or on the day typhoon signal No.8 or above or black rainstorm warning signal is hoisted will be sent on the next clearing day. In most cases, for instructions placed before the cut-off time, the transfer will be performed on the same day. Actual date and/or time of receipt is subject to the cut-off time, public holidays or processing time of correspondent bank/recipient bank.

Any remittance instruction (Non-DBS Remit) placed after 5:00 pm on a clearing day or on a non-clearing day will be processed on the next clearing day.

Any remittance instruction involving currency conversion placed after the cut-off time or on a non-clearing day will be effected according to the prevailing exchange rate when the instruction is submitted (except funds transfers in CNY to Mainland China) or when it is executed (for funds transfers in CNY to Mainland China).

In general, the recipient will be able to receive the funds within two to four working days of the recipient bank from the transfer date. However, this may vary depending on the destination or bank to which the payment is made.

When you submit your remittance instruction to a new payee via DBS iBanking successfully, the corresponding payee will be added to the registered payee list automatically.

Please ensure you have provided correct information and have sufficient funds for the processing of the remittance instruction. In the event of missing information and/or insufficient funds in your debit account, the Bank reserves the right to reject the instruction.

If the instruction has been executed, no amendment or cancellation can be made unless agreed by the recipient or the recipient bank. Please visit any of our branches to amend or cancel any instruction submitted. An amendment or cancellation fee will be charged.

All remittance instructions are subject to verification by the Bank and may be rejected at the Bank’s sole discretion.

The daily limit for Overseas Funds Transfer will be reset to HK$0 if no such transaction is conducted for 12 months.

- Transfer CNY to Mainland China via DBS Remit is only applicable to customers with a single name account with HKID. This service is not applicable to customers holding only passports or customers with only a joint account.

- Any CNY remittance instruction to Mainland China placed after the cut-off time or on a non-clearing day (“Clearing day” means Mondays to Fridays, except public holidays in Hong Kong.) will be processed on the next clearing day.

- The daily limit of transfer CNY to Mainland China is CNY80,000 per person for Hong Kong residents.

- The name of the beneficiary account in Mainland China must be identical with the name of remitter’s account. If we are unable to confirm or verify that you are the holder of both accounts, we reserve the right to reject the remittance instruction and remove the related payee from the registered payee list.

- If the name of the beneficiary account in Mainland China is registered in Chinese, your name in the Recipient Bank’s record must be identical (including identical usage of traditional or simplified Chinese characters) to the name in your identity document registered with DBS Bank (Hong Kong) Limited.

DBS Remit# via DBS iBanking/ DBS digibank HK | |

|---|---|

Handling charge | Waived |

Cable Charges | Waived |

Correspondent Bank Charges | Waived |

Telegraphic Transfers | |

| |

DBS Account Customers | HK$100 per transaction (for both individuals and non-individuals of Consumer Banking Group) |

DBS Treasures Customers | Waived (for both individuals and non-individuals of Consumer Banking Group) |

| |

DBS Account Customers | HK$250 per transaction (for both individuals and non-individuals of Consumer Banking Group) |

DBS Treasures Customers | HK$200 per transaction (for both individuals and non-individuals of Consumer Banking Group) |

| |

DBS Account Customers | HK$100 per transaction |

DBS Treasures Customers | Waived |

| |

| HK$150 (waived for telegraphic transfer initiated via DBS iBanking) |

| |

| HK$100 per cable |

| |

RMB - to Mainland China - to overseas |

At cost HK$250 per transaction |

EUR / GBP | HK$400 per transaction |

HKD / USD & other currencies | HK$250 per transaction |

# Applicable for transferring USD to United States, CAD to Canada, GBP to United Kingdom, AUD to Australia, SGD to Singapore, RMB to China, EUR to designated Eurozone countries, INR to India, IDR to Indonesia, PHP to Philippines, JPY to Japan and THB to Thailand.

^ If charge at cost is higher than the respective charge, at the Bank’s discretion, the Bank may adopt a higher charge.

Related Information

We Welcome your Feedback

Need more help?

Contact support and we'll try to resolve your issue quickly.

Contact Customer Support