- Gold has been on a scintillating rally since the start of March gaining 13.0% during the month; this was despite a strong dollar and resilient US Treasury yields

- Safe haven demand and rate cut bets are likely drivers for the latest rally

- Central bank buying and bar/coin demand from private investors provide support and stability for gold price

- Further right tail risk from US election cycle and fiscal sustainability concerns

- Upgrade target price to USD2,500/oz. (vs USD2,250/oz. previously)

Related insights

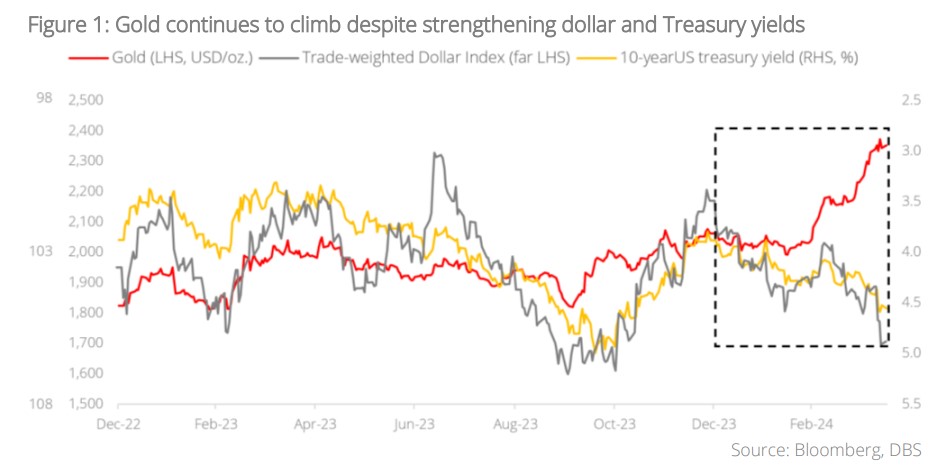

A surprise rally. The first two months of 2024 saw muted gold price movement, with bullion notching a marginal loss of -0.9% as at end February. This weakness, however, was short-lived as gold quickly rallied to a series of new record highs in subsequent weeks. As at 15 April, gold trades at USD2,353/oz., approximately 14.1% up year-to-date. This rally, while impressive, has left market observers puzzled as bond yields and the US dollar did not weaken nearly enough to warrant such a substantial rally. In fact, between 1 March and 1 April, the 10-year US Treasury yield and DXY index strengthened 8.9% and 2.0% respectively; gold rallied 13.0% during the same period. This move affirms our view that the inverse relationship between gold, and Treasury yields have indeed weakened substantially. With gold’s recent moves seemingly driven by factors outside of the dollar and Treasury yields, analysts have been left divided on what is responsible for this recent sudden spike in gold price.

Geopolitical risk a key short-term driver. In the past, a gold rally as significant as this will usually be accompanied by a clear catalyst or risk event. This time however, reasons have been more ambiguous. Several factors have been postulated for the recent rally, including safe haven demand as well as weakening US macroeconomic data. On safe haven demand, the protraction and escalation of the long-standing Russia-Ukraine war and the Israel-Hamas conflict continues to boost the allure of gold as a hedge against geopolitical risk. With Iran entering the fray in the Middle East, geopolitical risk premiums for gold will likely rise moving forward.

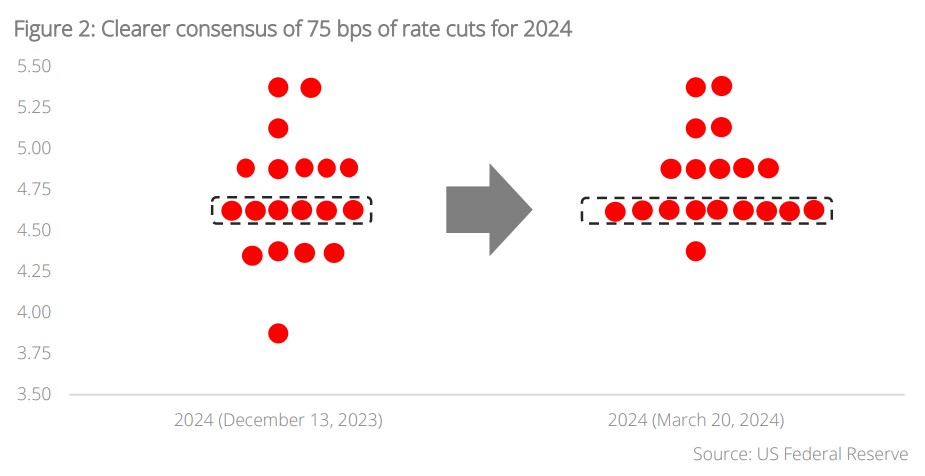

US macro data mixed, but rate cut bets are still on. On the US macro front, data points have been mixed, ISM manufacturing PMI showed a larger-than-expected contraction in February, falling to 47.8 from 49.1 in January. Non-farm payroll figures also showed vulnerability after December and January numbers were revised downward by a collective 167,000 jobs. On the other hand, inflation has proven sticky, with the headline figure rising to 3.8% y/y in March. While the macro data has been ambiguous, minutes from the latest Federal Open Market Committee (FOMC) meeting in March showed increasing conviction to implement rate cuts this year. The 2024 year-end median Fed Funds Target remained at 4.6%, unchanged from the December 2023 meeting, but the distribution of votes has converged towards a clearer consensus; nine of the FOMC participants indicated 4.50-4.75% to be the appropriate target range for the federal funds rate, up from six participants during the December meeting. In short, rate cut bets are still firmly on the table this year, which is a positive thing for gold.

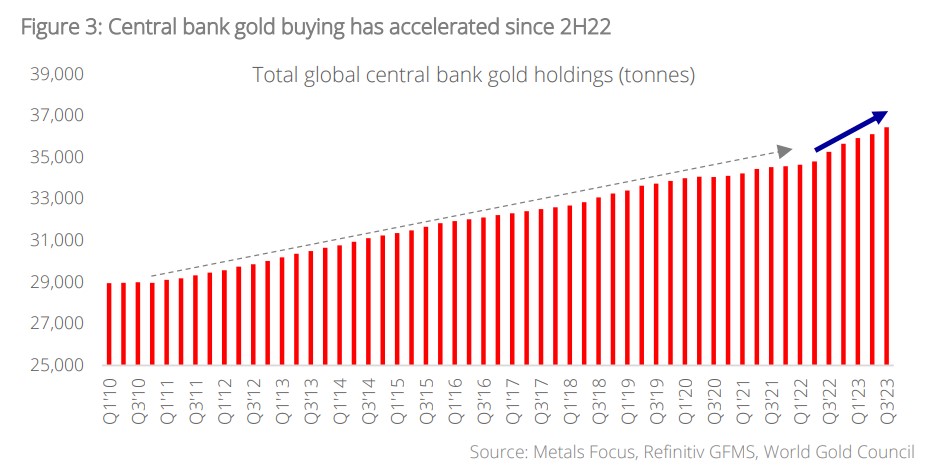

Central bank buying is a structural trend. While short-term factors like geopolitical risk and the trajectory of US monetary policy are pertinent in driving the price of gold, long-term factors are equally important as they provide a floor for prices. Case in point, central banks are price-sensitive buyers of gold, and as such, when gold experiences periodic sell-downs, it is not uncommon for some of them to partake in opportunistic buying, which will in turn help to support the gold price. Furthermore, central bank buying in general has picked up noticeably since 2H22, with total demand in 2022 and 2023 both exceeding 1,000 tonnes, which is significantly higher than the average annual demand of c.600 tonnes during the past decade. We expect this trend of elevated buying to persist as de-dollarisation gains momentum and central banks continue to shift their preferences towards real assets that are not at risk of sanctions or subject to cross-border custodial arrangements. The progressive deterioration of the inverse correlation between gold and rates supports the conjecture that the increase in central bank buying is more structural than cyclical, and will likely persist.

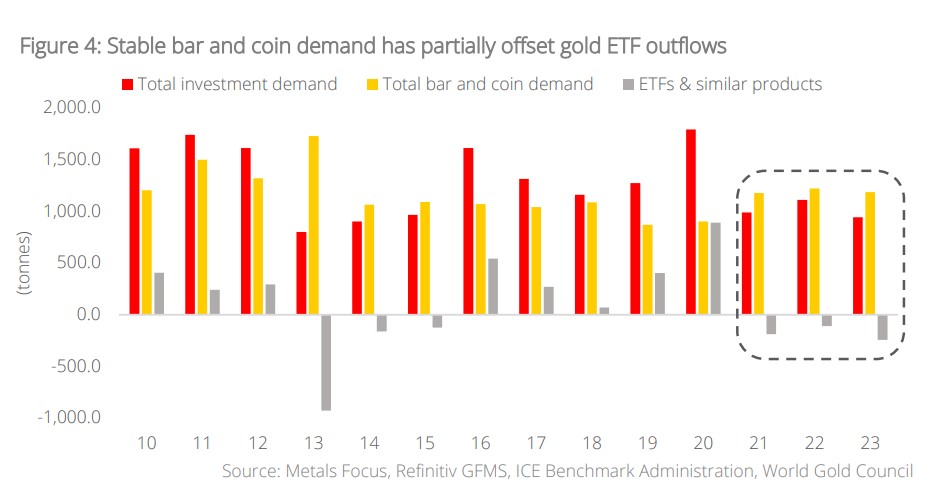

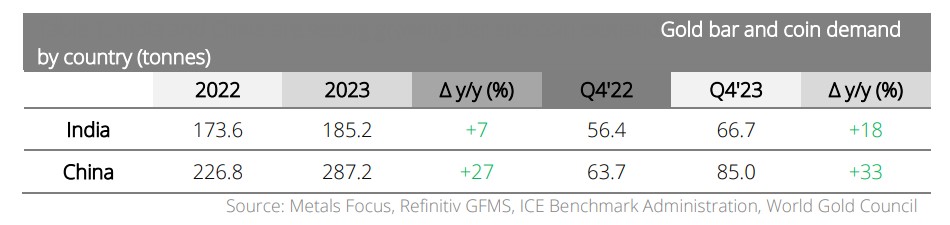

No ETF flows? No problem. Bar and coin demand to the rescue. While there has been a lot of focus on the sustained outflows for gold ETFs in the past three years, and how that has been a headwind for gold, we might be missing the forest for the trees here. Despite redemptions from gold ETFs from 2021 to 2023, investment demand for gold has held steady thanks to robust bar and coin demand. This was especially true for India and China, which saw bar and coin demand increase 7% and 27% respectively on a y/y basis. The allure of physical gold is not limited to central banks; private investors are also increasing their purchase of the precious metal. The shift towards privacy and tangibility has made many investors consider physical gold over ETFs, which lack privacy and anonymity since ETF transactions are recorded and holdings registered. Counterparty risk is also another problem that is solved by holding physical gold.

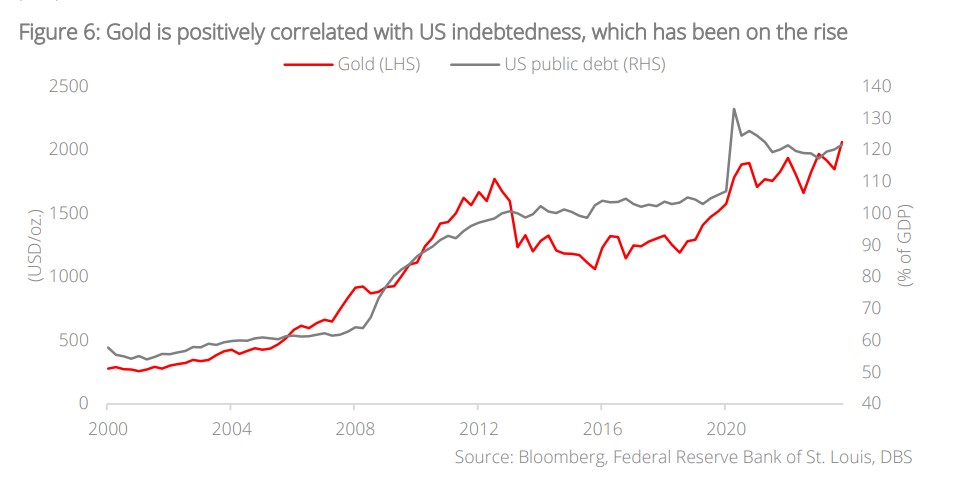

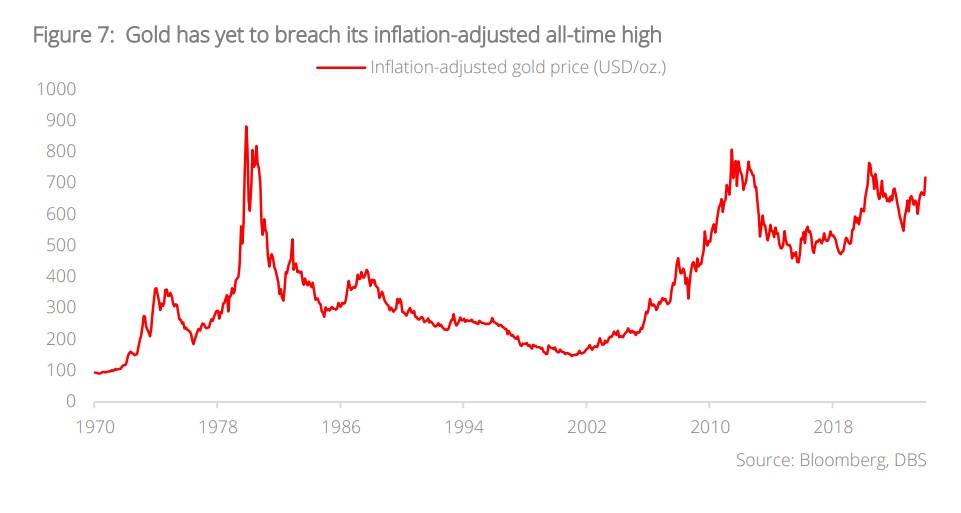

Where do we go from here? Most likely up. In the short term, there is risk of pullback because of the immense momentum that has accumulated behind the long-gold trade. Additionally strong US inflation data is calling into question if rate cuts will materialise in June. In the worst-case scenario, a hawkish pivot by the Fed will likely cause a sharp pullback for the asset class. Nonetheless, there remains a strongly bullish skew to gold on balance. While rate cuts could be further delayed, it is unlikely that monetary policy will remain this restrictive on an indefinite basis given the stress in the commercial real estate sector as well as the growing level of indebtedness of the US government. When rates eventually trend lower, that will be a positive catalyst for gold. On the geopolitical front, escalating conflict in Ukraine and the Middle East is intensifying safe haven demand for bullion in the short to medium term. But far from being a fleeting driver, geopolitics also acts as a longer-term catalyst for gold through increasing emerging market central bank buying. Strong bar and coin demand from private investors further add to the long-term fundamental demand for bullion. Finally, there is potential right tail risk from the US election cycle this year and fiscal sustainability concerns, which further fortifies market fear. It is on this basis that we upgrade our 12M rolling target price for gold to USD2,500/oz. (vs USD2,250 previously). Overall, we continue to advocate for investors to hold gold in in their portfolios for its favourable risk-reward and risk diversification properties.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.