The newly announced Wealth Management Connect Pilot Scheme lets you tap into more potential for growth across the Mainland Greater Bay Area (“GBA”). Thanks to this new pilot scheme, you can invest in cross-boundary wealth management products offered by financial institutions in the GBA.

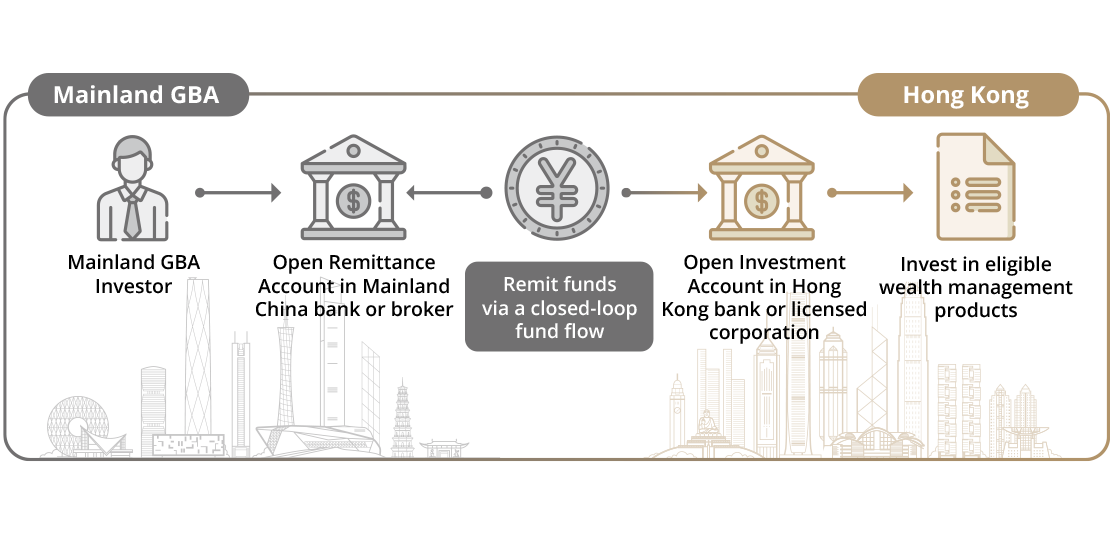

For Mainland GBA Investor*

Eligible customers can open a dedicated investment account in Hong Kong and Macao banks or licensed corporation and remit funds through a closed-loop system to purchase eligible investment products sold by Hong Kong and Macao banks or licensed corporations. Each eligible Southbound investor can only open one Mainland Remittance Account in a bank or broker respectively and one Hong Kong and Macao Investment Account in a bank or licensed corporation respectively at any time.

* The Greater Bay Area Mainland cities comprises the nine municipalities of Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing in Guangdong Province.

-

Aggregate quota

The aggregate quota for the Southbound Scheme is initially set at RMB 150 billion

-

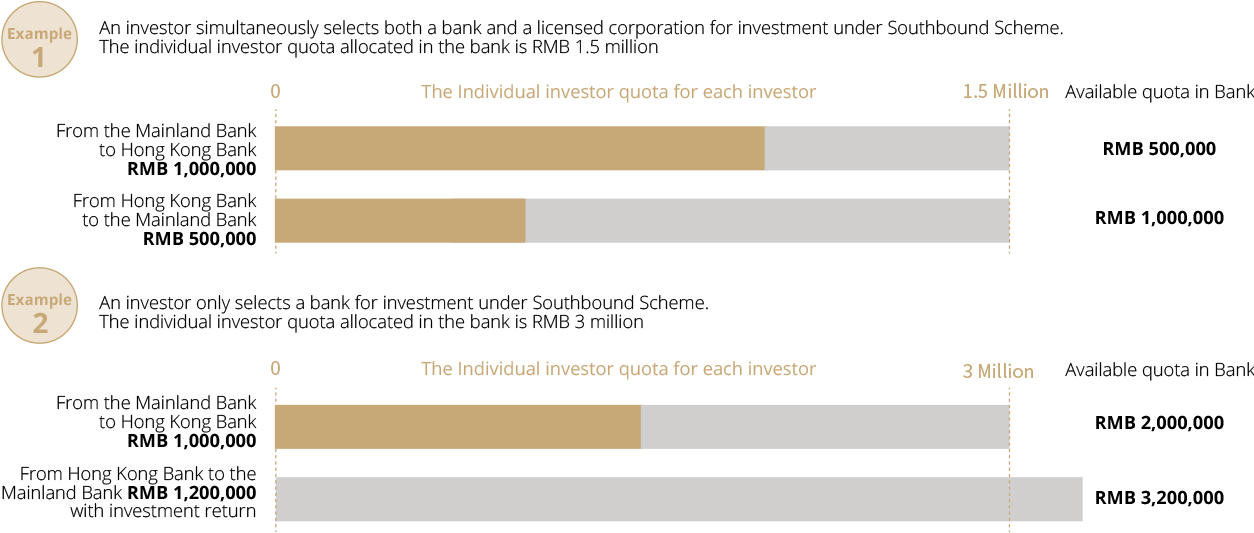

Individual investor quota

The Individual investor quota for each investor is RMB 3 million*

Individual investor quota calculation:

Usage of individual investor quota

under Southbound Connect

=

Cumulative remittances

from the Mainland to HK -

Cumulative remittances

from HK back to the Mainland

* If an investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will each be RMB 1.5 million.

Wealth management products under Southbound Connect include

-

Investment products (excluding investment products listed and traded on the Hong Kong Exchanges and Clearing Limited)

(1) All funds domiciled in Hong Kong and authorized by the SFC, primarily investing in Greater China equity and assessed as “non-complex” by Hong Kong banks distributing such products;

(2) Except for the funds specified in item (1), funds that are domiciled in Hong Kong and authorized by the SFC and are assessed as “low” risk to “medium-high” risk and “non-complex” by Hong Kong banks distributing such products, excluding high-yield bond funds and single emerging market equity funds;

Fund search(3) Bonds assessed as “low” risk to “medium” risk and “non-complex” by Hong Kong banks distributing such products.

-

Deposits

RMB, HKD and foreign currency deposits namely US dollar, Euro, UK Pound Sterling, Australian dollar, New Zealand dollar, Canadian dollar, Swiss Franc, Japanese Yen and Singapore dollar.

Why partner with DBS for your Wealth Management Connect journey

Best of Investment Choices

Intelligent Digital Journeys

Exceptional Customer Service

DBS, PSBC and SRCB

Your partners for success in the Greater Bay Area

To bring you a first-rate experience, we’ve partnered with PSBC, SRCB and DBS China in the GBA WMC Southbound Scheme. These partnerships let us deliver seamless service to help you explore opportunities between the Mainland and Hong Kong.

You can choose either one of our Mainland partner banks to open the Remittance Account

How Wealth Management Connect can benefit you

Diversify your portfolio and grow your wealth with DBS Hong Kong’s wide range of eligible Wealth Management Connect products with different risk ratings.

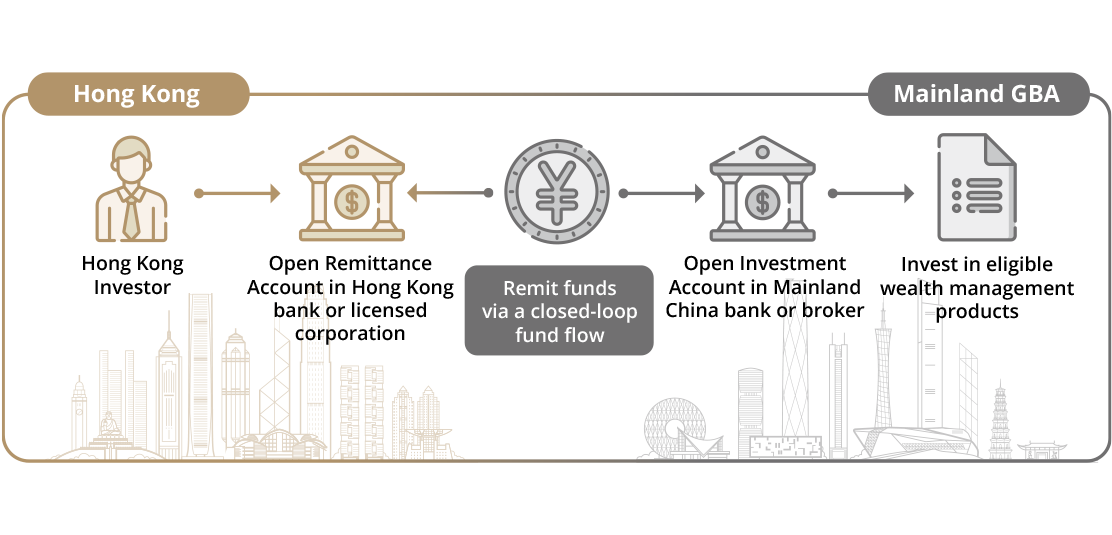

Hong Kong investors can open a dedicated remittance account in their place of residence and remit funds through a closed-loop system to purchase eligible wealth management products sold by Mainland banks or broker in the Greater Bay Area Mainland cities*. Each eligible Northbound investor can only open one Hong Kong and Macao Remittance Account in a bank or licensed corporation respectively and one Mainland Investment Account in a bank or broker respectively at any time.

*GBA Mainland cities refer to nine municipalities of Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing in Guangdong Province

-

Aggregate quota

The aggregate quota for the Northbound Scheme is initially set at RMB 150 billion

-

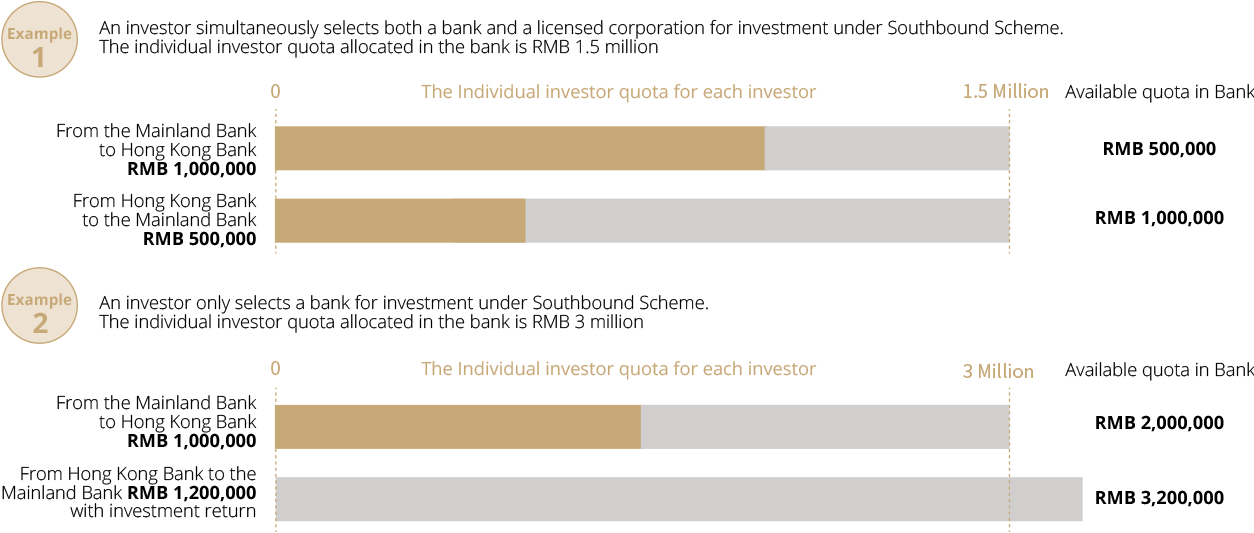

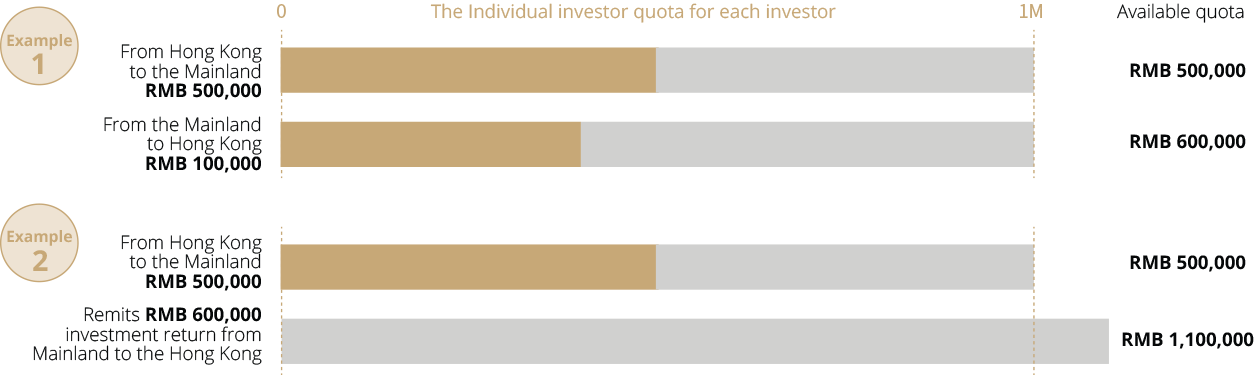

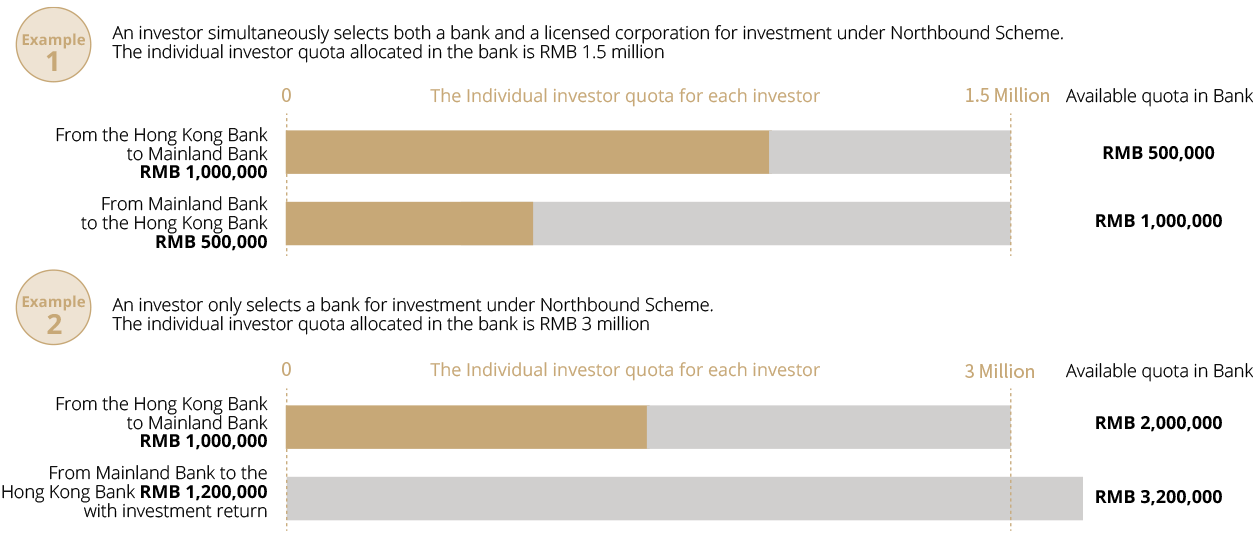

Individual investor quota

The Individual investor quota for each investor is RMB 3 million*

Individual investor quota calculation:

Usage of individual investor quota

under Northbound Connect

=

Cumulative remittances

from HK to the Mainland -

Cumulative remittances

from the Mainland back to HK

* If an investor simultaneously selects both a bank and a licensed corporation for investment under Northbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will each be RMB 1.5 million.

Investment products under Northbound Connect include

-

(1) RMB-denominated deposit products;

(2) Public securities investment funds with risk rating “R1” to “R4” (excluding commodity futures funds), specific product is subject to actual provision of DBS CN.

Why partner with DBS for your Wealth Management Connect journey

Offer different investment choices

Excellent Customer Service

DBS

Your partners for success in the Greater Bay Area

To bring you a first-rate experience, we’ve partnered DBS China in the GBA WMC Northbound Scheme. The partnership lets us deliver seamless service to help you explore opportunities between the Mainland and Hong Kong.

How Wealth Management Connect can benefit you

Diversify your portfolio and grow your wealth with DBS Hong Kong’s wide range of eligible Wealth Management Connect products with different risk ratings.