Trusts

Frequently Asked Questions

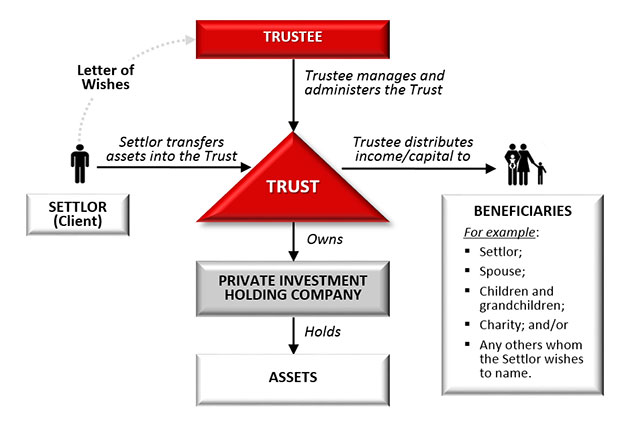

You (as the Settlor) and the Trustee will execute a Trust Deed or instrument which sets out the terms and conditions under which the Trustee holds and administers the Trust assets.

You will also provide the Trustee with a Letter of Wishes to provide guidance in relation to how and when Trust assets are to be distributed to your Beneficiaries. You can include criteria/ conditions which beneficiaries have to fulfill prior to receiving any Trust distributions. This is a flexible document that can be changed by you to meet your family’s changing circumstances.

Assets you transfer into a Trust will no longer be held in your personal name. Therefore, they will not be frozen after your lifetime and subject to probate. This provides greater security for your assets in unforeseen circumstances, making a trust an extremely useful tool in succession planning and wealth protection.

Key differences between a Trust and will include:-

| TRUST | WILL |

|---|---|

A Trust is a confidential arrangement | A will is a public document |

Distribution plan is private | Distribution plan is public |

Avoids the probate process | Goes through the probate process |

Protects assets | Open to challenge |

Provides long-term distribution in a flexible manner, in the best interest of the beneficiaries | Fixed and inflexible |

Yes. Contrary to popular belief, such assets may be frozen after the passing of a co-owner.

In addition this form of ownership does not provide any asset protection or long-term distribution plans.

It depends on the type of Trust you set up. A Trust can be structured to allow you or someone you choose to manage investments within the Trust directly, without additional approval from the Trustee.

If you are one of the Beneficiaries, you will also have the ability to request for distributions from the Trust.

Private Trusts can be very simple if they are intended for limited purposes. On the other hand, they can also be customized to suit more complex needs.

Trusts may be broadly categorized as revocable/ irrevocable trusts, and fixed interest/discretionary trust.

DBS Wealth Planning provides personal trust, estate planning and liquidity planning services to clients of DBS Private Bank.

Our experienced team of Wealth Planners are based in Singapore and Hong Kong. The team includes qualified lawyers and accountants, insurance specialists and members of the Society of Trust and Estate Practitioners. Our Wealth Planners are fluent in English, Mandarin, Cantonese, Hokkien, Malay and Bahasa Indonesia.

Our open platform allows us to offer you best-in-class advice for the most suitable structure to meet your unique needs. You can also choose to have your private trusts managed by our in-house trustee.

About DBS Trustee Limited

DBS Trustee Limited has been providing trustee and fiduciary services in Singapore since 1975. We are a Singapore-incorporated company wholly-owned by DBS Group Holdings Ltd, one of the largest banking groups in the region. We are a licensed trust company regulated by the Monetary Authority of Singapore and are an approved trustee under the Securities and Futures Act. We are trustees for private family trusts, as well as numerous REITs listed on the Singapore Stock Exchange.

Useful Links

Market Update and Tools

Talk to our Staff

(852) 3668 8008

Or let us contact you

Other hotlines

Others

- Feedback Form

- Video training on General Knowledge of Derivatives

- IPO Shares Subscription Service

- IPO Allotment Result

Need help?

Ways to get our

Help & Support