Request ATM card / Octopus ATM card

Customers with DBS Bank Account can apply for a DBS Octopus ATM card with Automatic Add Value Service ("AAVS") or a general DBS ATM card free of charge*.

*This charge is subject to change. If you have any queries concerning the fees and charges, please contact our branch staff or visit our website at www.dbs.com.hk. For details of other services charges, please refer to our Bank Charges Schedule.

Apply for an ATM Card / Octopus ATM Card on DBS digibank HK:

Login DBS digibank HK

Select “More” and then navigate to “ATM Card Services” tab

Select “Apply for a New Card”

Select Card Type: DBS ATM Card / DBS Octopus ATM Card

Select Primary Account

Select Octopus Auto Top-up Amount (if any)

Confirm your application details and tap “NEXT”

Create 6-digit ATM PIN and tap “SUBMIT”

New card application completed

Alternatively, you can download ATM Card Application Form or visit any of our branches for the application.

ATM card will be mailed to your registered address within 7 working days after application.

Below are the key features of DBS Octopus ATM card:

Octopus Automatic Add Value Service ("AAVS") is ready for you - The AAVS has been pre-activated for you. You can enjoy the AAVS by simply acknowledging the new card.

Two reload amount to fit your needs - You can choose to reload either HK$500 or HK$250 per AAVS. Whenever your remaining value reaches zero or negative balance, your selected reload amount will be reloaded on your card (AAVS reload once per day) *.

Octopus Online Payment - You can make online payment with Near Field Communication (NFC)-enabled Android mobile devices or iOS mobile devices paired up with Octopus Mobile Reader conveniently and easily with just "one-tap" anytime anywhere #. Offer you an easy, convenient, fast and secure online shopping experience.

One card does it all! - You can also enjoy shopping convenience with payment through EPS and China UnionPay’s merchant point-of-sale terminals.

* If the account balance is insufficient, overdraft maybe resulted in the HKD current account. Any overdraft (including any overdrawn amount which exceeds the pre-agreed overdraft limit) shall be subject to the provisions of the Bank Accounts and Services Terms and Conditions (including but not limited to the payment of overdraft interest and other charges), and customers’ rights and obligations shall be determined accordingly.

# The Service is available at the specific merchants' mobile apps only, please visit www.octopus.com.hk for details. Some merchants may charge service fees or administration fees for their online shopping services. Before confirming your payment, please refer to the relevant information provided by the merchants.

Please acknowledge or use your new card by any of the below channels within 4 months from its issue date, otherwise the new card, together with its Octopus functions (if applicable) will become invalid:

Acknowledge this card at our website go.dbs.com/hk-atm-en, or

Perform a transaction at ATMs, or

Make a purchase by means of EPS

Login DBS digibank HK

Select “More”

Select “ATM Card Services”

Select “Manage overseas transaction settings”

Choose the ATM card to activate the OTA function

Turn on “Activate overseas withdrawal”

Input the Start Date, End Date and Daily Limit

Press “Next”

After review, please click “Confirm”

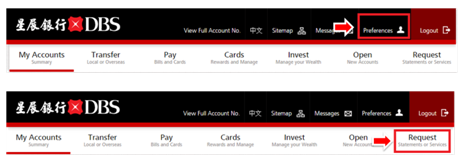

Login DBS iBanking account

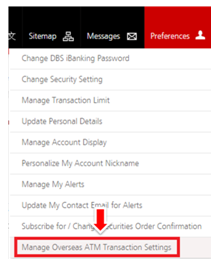

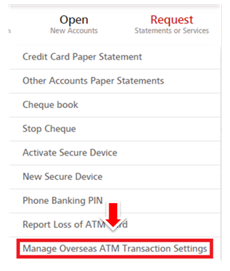

Click “Preference” at the right upper corner (Please refer to point 3a) or “Request” at the top menu bar (Please refer to point 3b)

Choose “Manage Overseas ATM transaction Settings”

a. Click “Manage Overseas ATM transaction Settings” under “Preference”

b. Click “Manage Overseas ATM transaction Settings” under “Request”

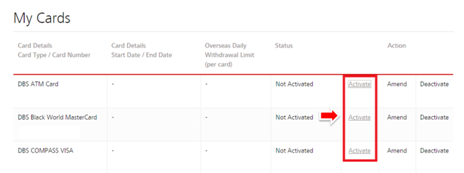

Click “Activate” of the card that you would like to activate Overseas ATM transaction settings

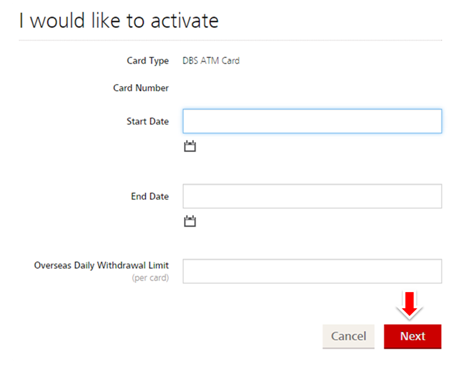

Select “Start Date”, “End Date” and “Overseas Daily Withdrawal Limit”

Press “Next”

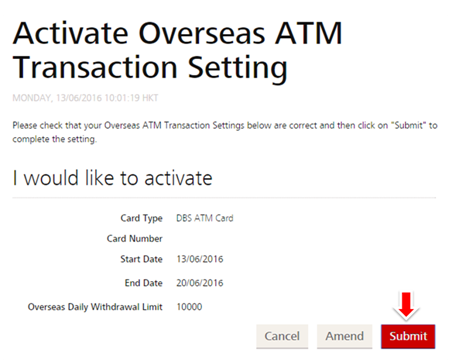

Double confirm activate details, press “Submit” if nothing need to change

System will confirm your instruction and send SMS alert to registered mobile number

You can now activate the overseas ATM transaction function, set the activation period and adjust the overseas daily withdrawal limit through the following channels:

DBS ATMs in Hong Kong*

JETCO ATMs in Hong Kong, Macau and Mainland China#

*Activation of Overseas Transaction Function at DBS ATMs:

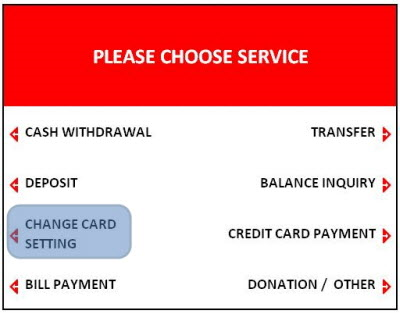

Select "CHANGE CARD SETTING" on the main screen

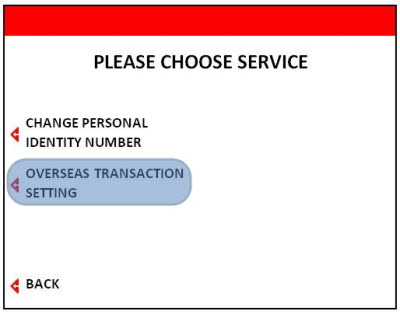

Select "OVERSEAS TRANSACTION SETTING"

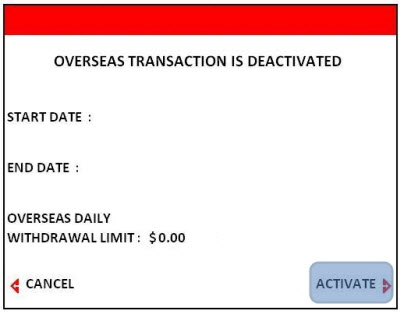

Select "ACTIVATE" to start inputting the "START DATE", "END DATE", and "OVERSEAS DAILY WITHDRAWAL LIMIT"

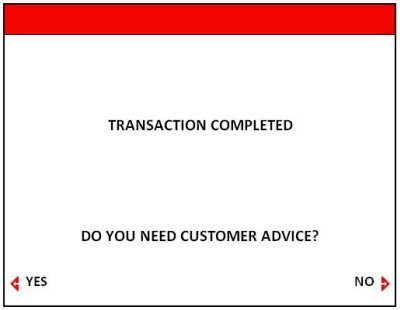

Upon completing the input of overseas transaction settings, select "CONFIRM" to complete the transaction

Upon confirmation of overseas transaction setting, please select if you want a customer advice

#Applicable to JETCO ATMs in Hong Kong, Macau and Mainland China with the signage of

For enquiries, please contact our DBS Customer Service Hotline at (852) 2290 8888, or visit any of our branches.

Related Information

We Welcome your Feedback

Need more help?

Contact support and we'll try to resolve your issue quickly.

Contact Customer Support