Join DBS Treasures Now

DBS Treasures is committed to being your trusted, intelligent financial partner, offering unparalleled for all your premium wealth Management needs. Join by 31 December 2025 to enjoy exclusive Welcome Rewards of up to HK$53,800. Discover bespoke benefits, including generous new fund rebates for your strategic investment and access to our distinguished client referral program.

Mobile Account Opening Reward

Wealth Management Accounts Reward

New Funds Reward

Investment Product Take up Reward1

Investment Product Balance Reward2

Insurance Product Balance Reward3

Securities Transfer-in Rewards

Online Equity Trading Offer9

Online Fund Investment Offer10

Online Regular Fund Investment Plan (RFIP) Offer 11

Rewards and Privileges

Enriching your everyday life and bringing you closer to exciting opportunities and enjoyable moments, beyond just providing wealth management services. Click here to explore how our rewards and privileges can elevate your lifestyle as you manage your finances with us.

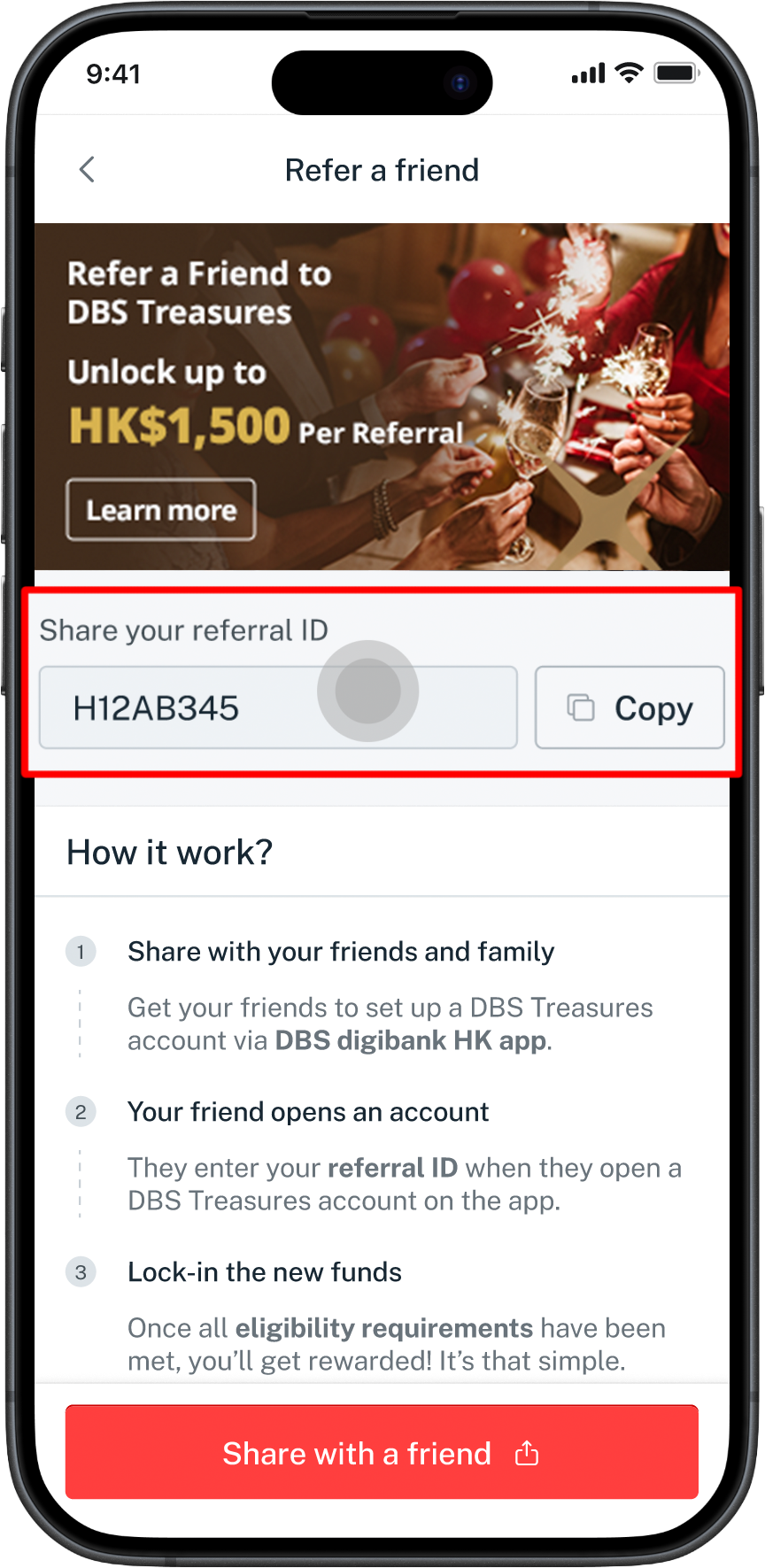

Account Opening Referral Reward

For each successful referral

| Referral Requirement | Referral Rewards |

|---|---|

| DBS Treasures, DBS Treasures Private Client or DBS Private Banking | HK$1,500 |

| Other customer | HK$1,200 |

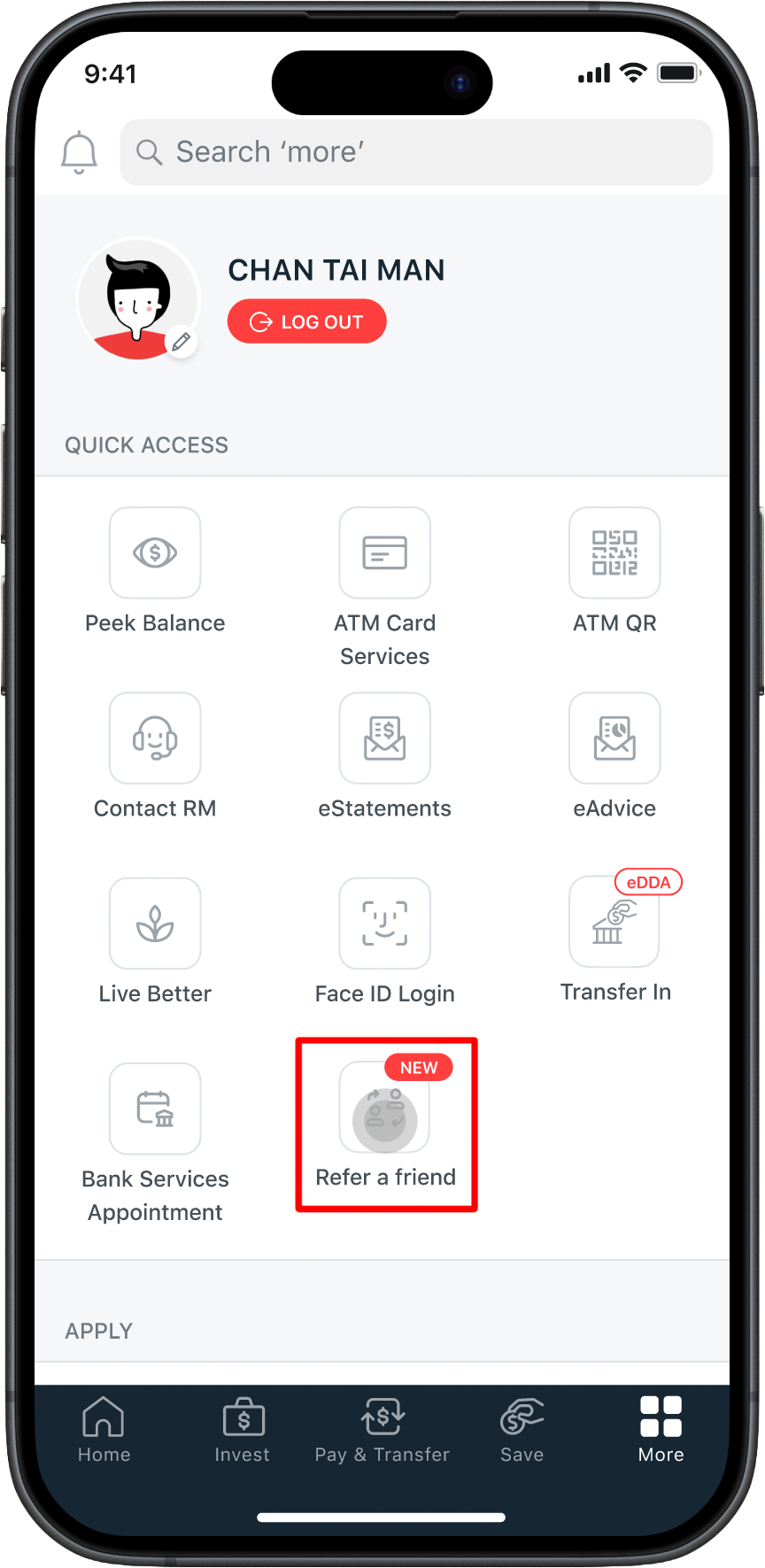

How to Refer Friends and Family

| 1. Share your referral ID |

|---|

|

|

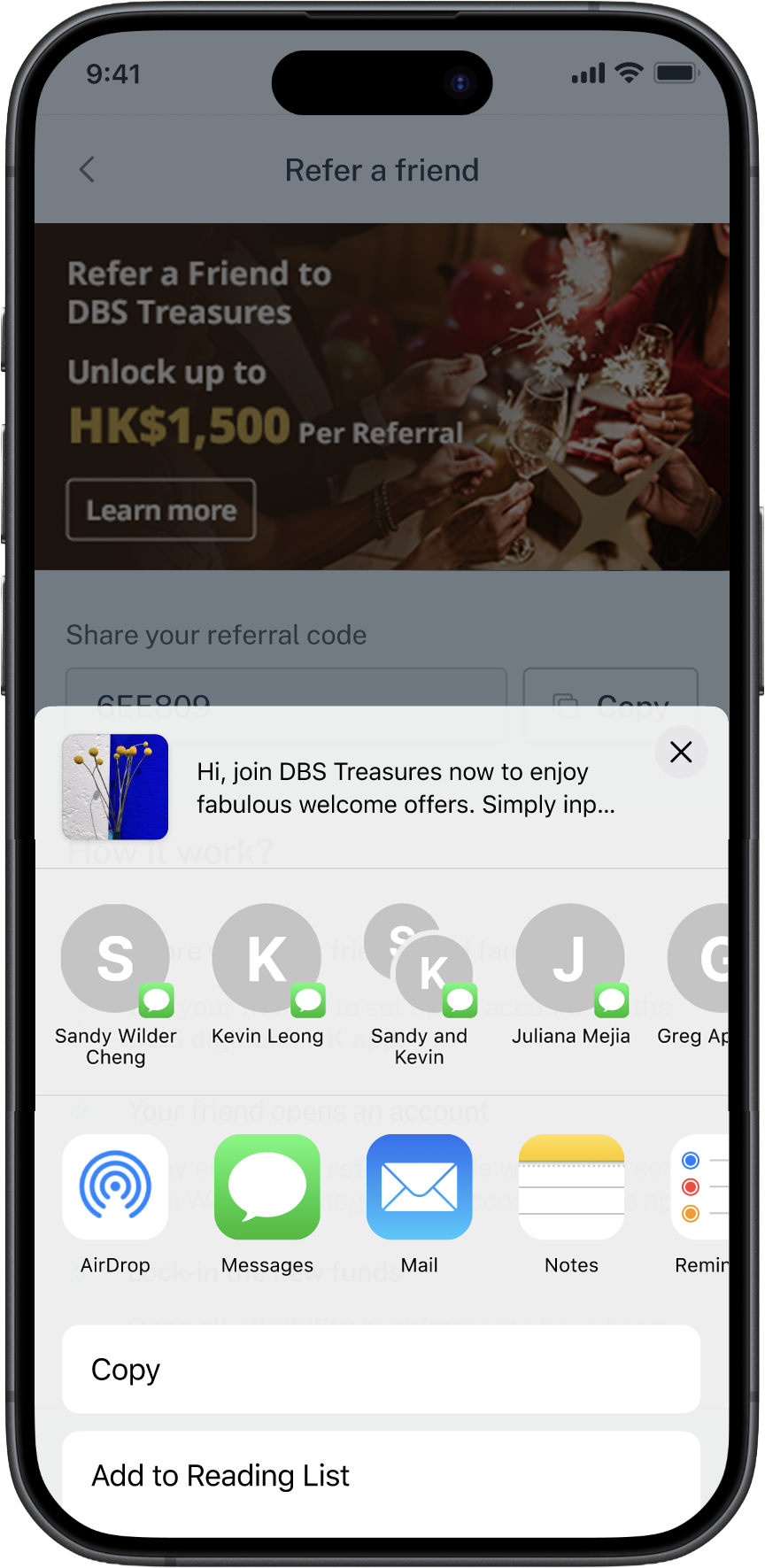

| 2. Share your referral form | ||||

|---|---|---|---|---|

|

||||

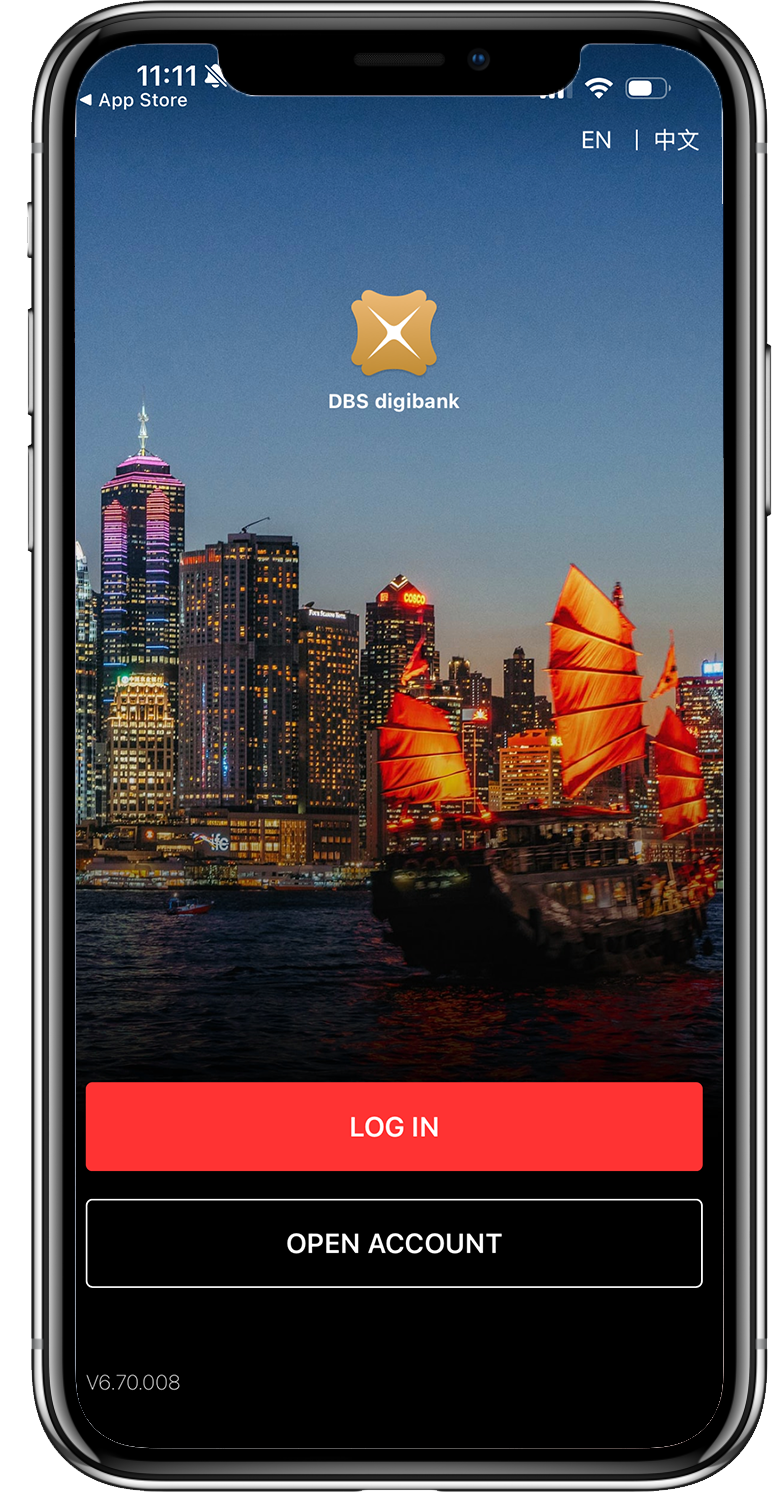

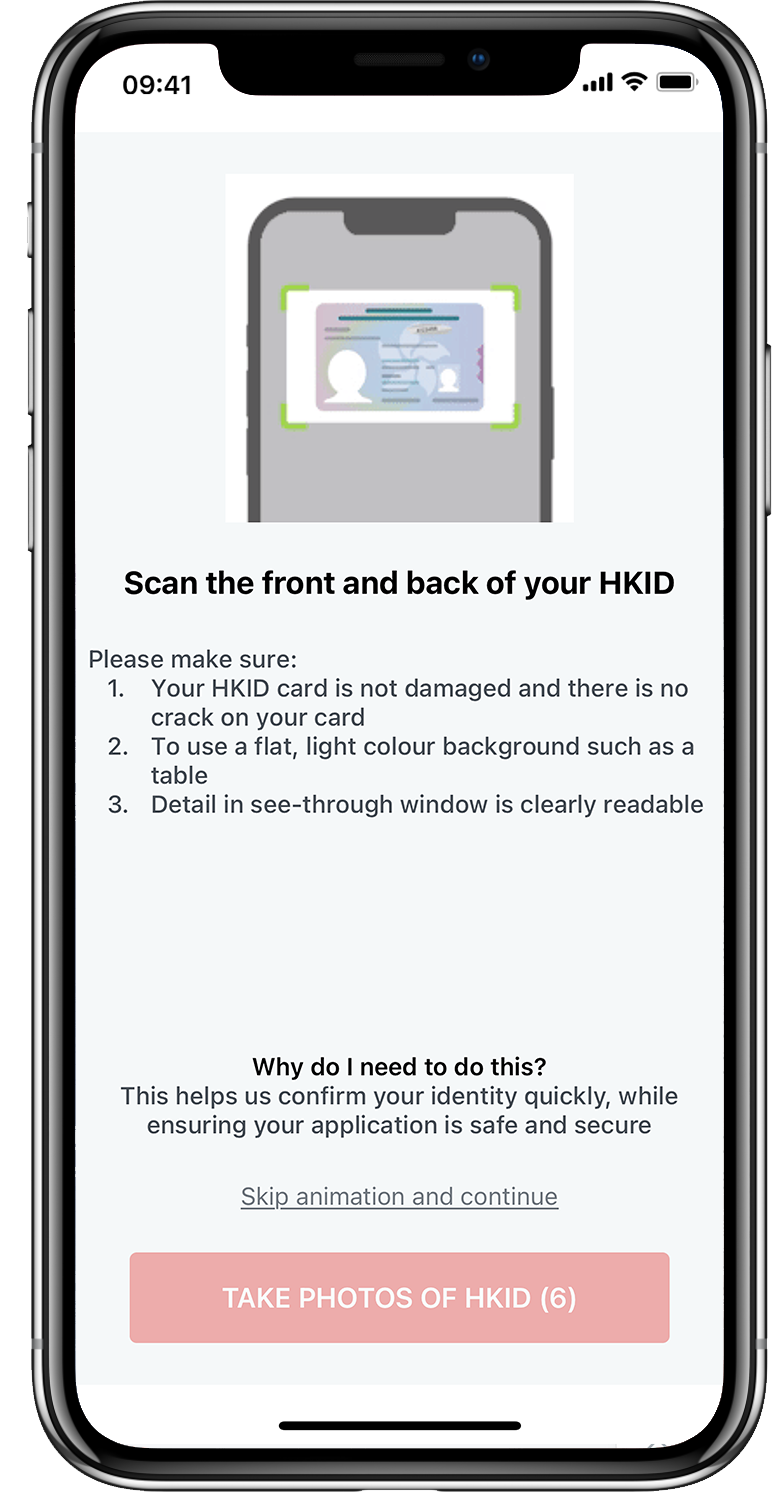

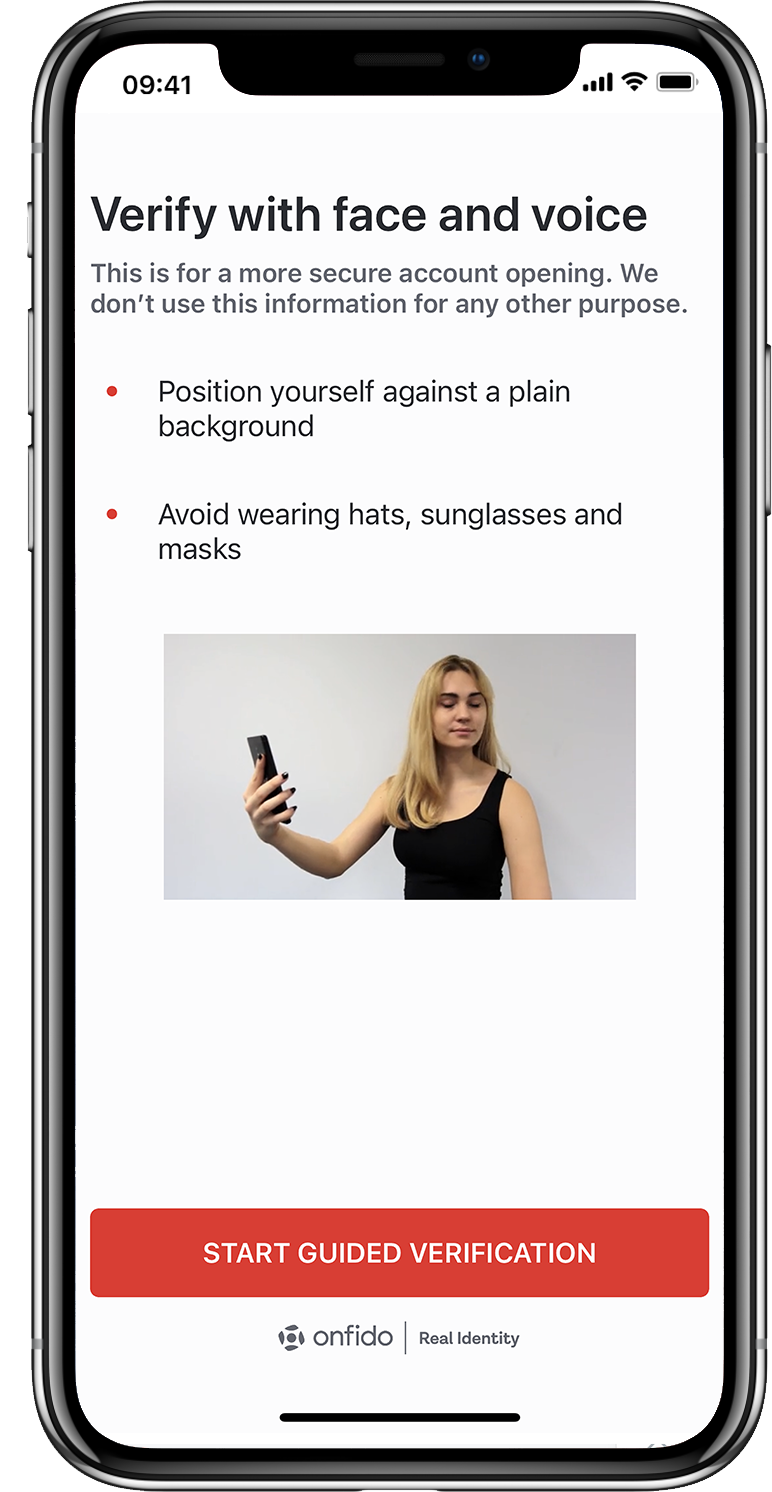

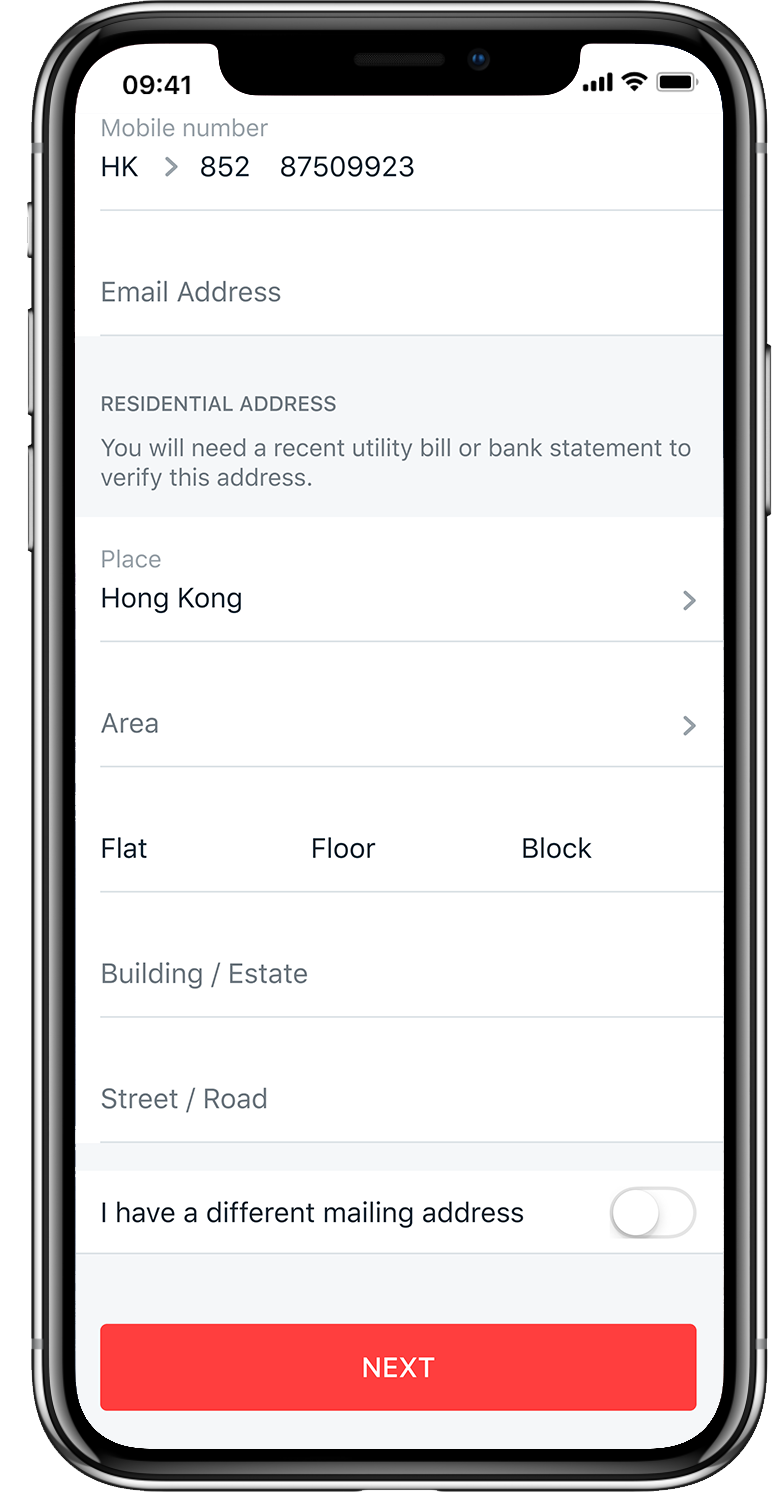

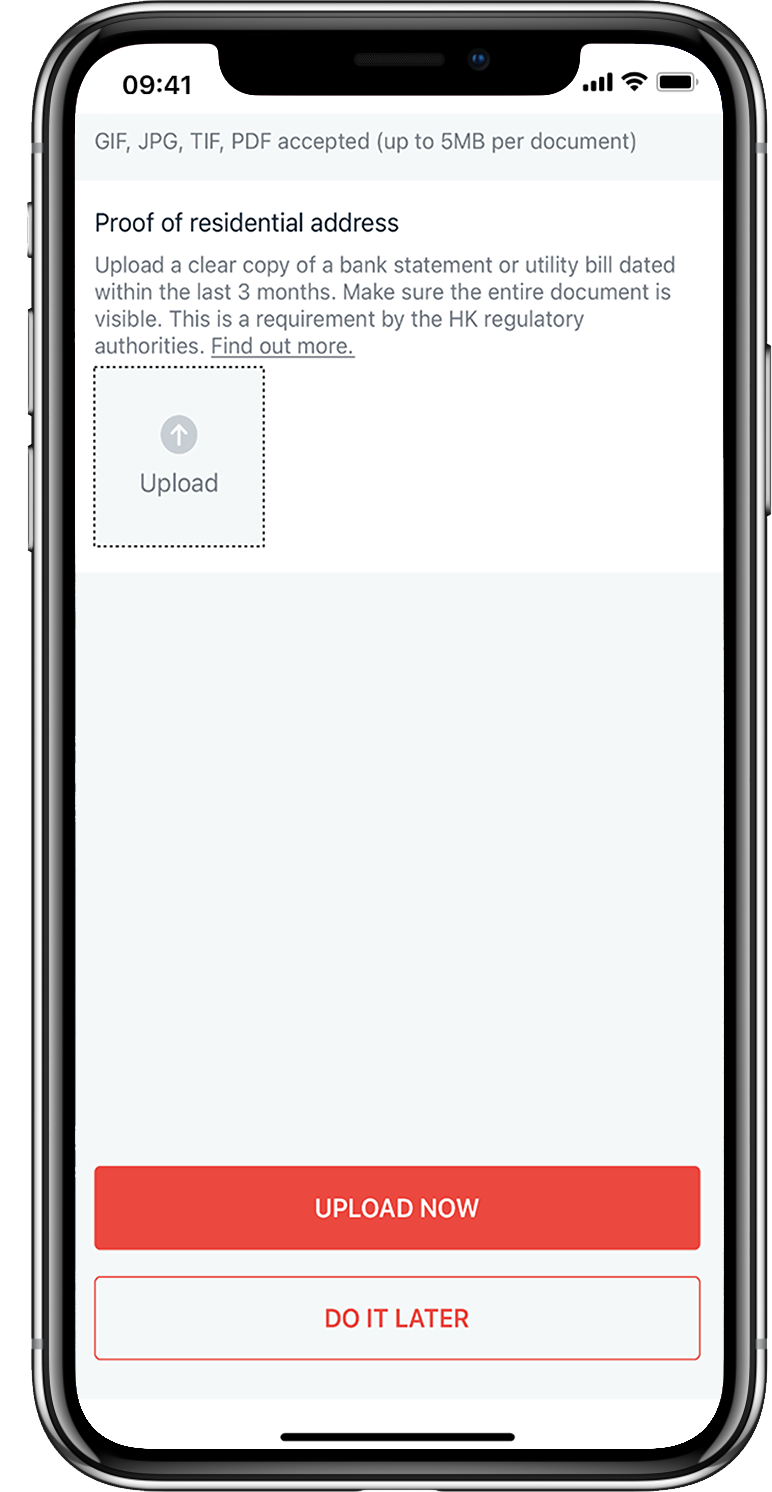

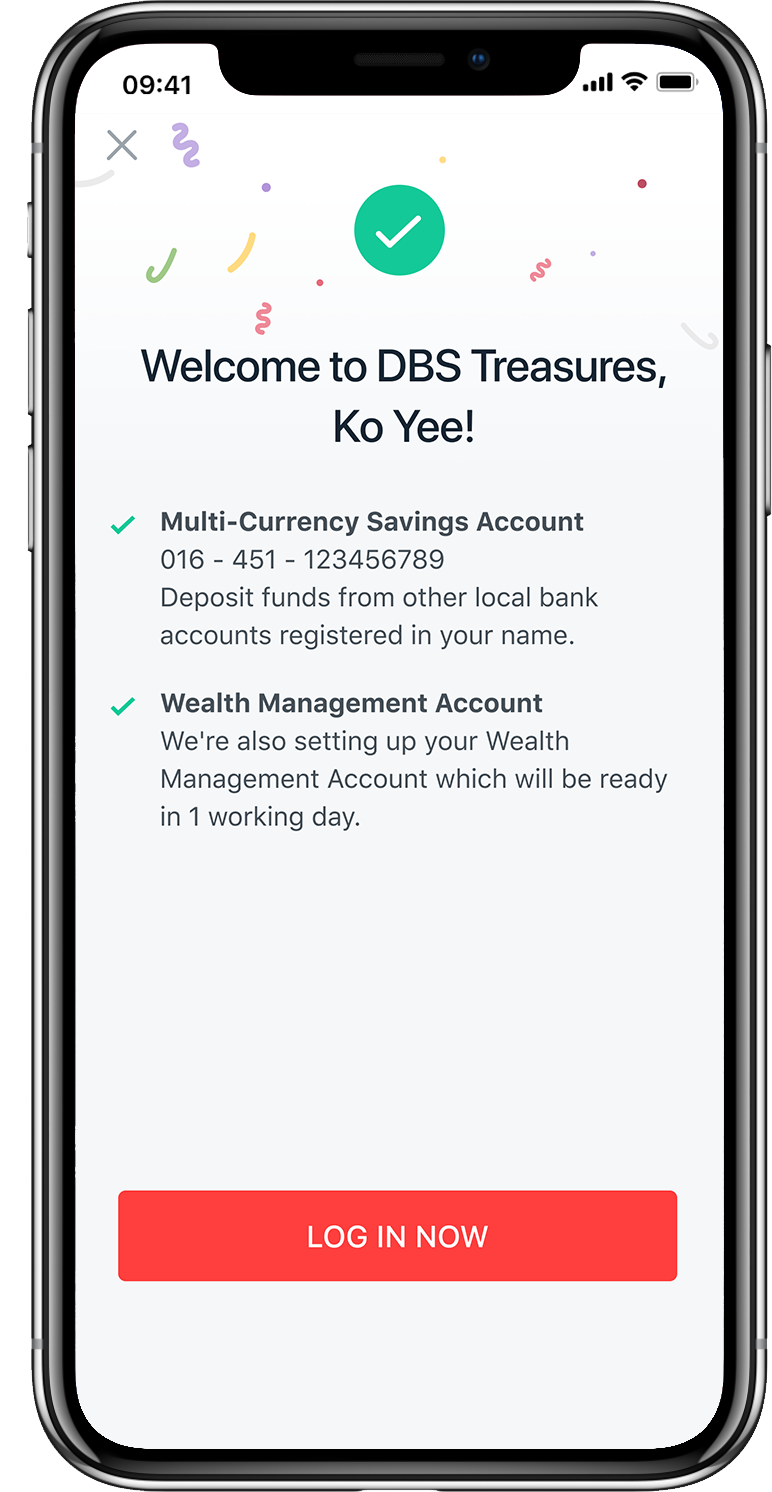

Join DBS Treasures - Open account via mobile banking

If you do not meet the above requirements to apply via the app, please make an appointment to open your account at our branch.

Maintain Funds and Reward Period

| Joining Date | Funds Counting Period | Fulfilment Period |

|---|---|---|

| October 2025 | October 2025 – December 2025 | February 2025 |

| November 2025 | November 2025 – January 2026 | March 2026 |

| December 2025 | December 2025 – February 2026 | April 2026 |

New Customer is required to maintain monthly Total Relationship Balance or/and Insurance Amount in the amount of HK$1,000,000 or above (or its equivalent in foreign currency(ies)) from 7th day of Joining Date to Funds Counting Period in order to be eligible for the Promotion.

-

Investment Product Take Up Reward

Eligible Product Transaction Category I. Securities Buy or sell transaction of securities in a single transaction amount of HK$10,000 or above (or equivalent) via Wealth Management Accounts II. Investment Funds Lump sum subscription or switching (only for transaction with minimum subscription fee of 1.2% or switching fee of 1%) of Investment Funds in a single transaction amount of HK$10,000 or above (or equivalent) via Wealth Management Accounts III. Foreign Exchange (“FX”) FX transactions in a single transaction amount of HK$200,000 or above (or equivalent) via Wealth Management Accounts -

Designated Investment Product Balance includes Equity Linked Products, Structured Notes with tenor at 2 years or above (i.e. currency linked notes, interest rate linked notes and/or commodity linked notes), Investment Funds (excluding Money Market Funds) and Bonds.

Designated Investment Product Balance Reward HK$200,000 – HK$500,000 HK$800 HK$500,001 – HK$1,000,000 HK$2,000 HK$1,000,001 – HK$3,000,000 HK$4,500 HK$3,000,001 – HK$5,000,000 HK$13,500 HK$5,000,001 or above HK$22,500 - For details on Insurance Product Balance Reward, please click here.

- For details on selected insurance products, please click here.

- For details on Overseas Transfer Reward, please click here.

- For details on Payroll Reward, please click here.

- For details on Debit Card Reward, please click here.

- For details on Credit Card Extra Welcome Offer, please click here.

- For details on Online Equity Trading Offer, please click here.

- For details on Online Fund Investment Offer, please click here.

- For details on Online Regular Fund Investment Plan Offer, please click here.

Terms and conditions apply.

For details of DBS Treasures Welcome Offers, please click here.

Frequently Asked Questions

- Aged 18 or above; and

- Maintain a monthly Total Relationship Balance of HK$1,000,000 (or its equivalent in foreign currency(ies)) or above

- Identification documents; and

- Valid proof of address issued within the last 3 months

No, there is no additional fee.

To borrow or not to borrow? Borrow only if you can repay!

Risk Disclosure

The Products are NOT protected deposits and are NOT protected by the Deposit Protection Scheme in Hong Kong.

Securities trading is an investment. The prices of stocks fluctuate, sometimes dramatically. The price of a stock may move up or down and may become valueless. It is as likely that losses will be incurred rather than profits made as a result of trading stocks. You should also note that investing in foreign market securities involves currency risk, you may suffer loss because of currency fluctuations. The investment decision is yours but you should not invest in any stock unless you have taken into account that the relevant stock is suitable for you having regard to your financial situation, investment experience and investment objectives.

Any person considering an investment should seek independent advice on the investment suitability when considered necessary.

Foreign Exchange involves risks. Customers should note that foreign exchange may incur loss due to the fluctuation of exchange rate.

Equity Linked Products, some Bonds and some Investment Funds are classified as complex products by the Bank. You are advised to exercise caution prior to investing.

The price of Paper Gold is volatile and value of the investment may go down as well as up. In the worst-case scenario, you may lose your entire principal. Investment in Paper Gold is not the same as investment in physical gold. Price changes in physical gold might not be reflected in price changes of Paper Gold. You should also be aware of the risk of foreign exchange rate fluctuations and may experience a loss on conversion of the investment back into other currency (including but not limited to your home currency).

Disclaimer

The life insurance products are underwritten by Manulife (International) Limited (incorporate in Bermuda with limited liability) (“Manulife”). DBS Bank (Hong Kong) Limited (the “Bank”) is acting as a licensed insurance agency of Manulife. The product is an insurance product and is neither a bank deposit nor a bank saving plan. You should not purchase any insurance plans solely on the basis of this promotional offer. Please ask the Bank for a copy of the policy provision, proposal and the product leaflet which will give you more details about the products including the ‘Important Information’ showing, among other things, the product risks. If you are in doubt, please seek independent professional advice.

The following risk disclosures are made to you by the Bank:

- For life insurance plans with a savings element, part of the premium pays for the insurance and related costs. The savings element is reflected in the surrender value of your policy and may not be guaranteed. The product is aimed at customers who can pay the premiums for the whole of the premium payment period. As a result, you are advised to save enough money to cover the premiums in the future. You should be prepared to hold the product for the long term to achieve the savings target. However, under certain circumstances the surrender value could still be less than the total premiums you have paid, even though you hold the policy over a long period.

- For life insurance plans without a savings element, there is no cash value for the product. The premium pays for the insurance and related costs. The product is aimed at customers who want an insurance product of the nature as described in the product leaflet and can pay the premiums as long as they want the protection. As a result, you are advised to save enough money to cover the premiums in the future.

- Credit Risk - Any premiums you paid would become part of Manulife’s assets and so you will be exposed to Manulife’s credit risk. Manulife’s financial strength may affect its ability to meet the ongoing obligations under the insurance policy.

- Risk from cashing in (surrender) early (Only applicable for life insurance plans with cash value) - If you cash in the policy, the amount Manulife will pay is the surrender value worked out at the time you cash in the policy, less any amount you owe Manulife. Depending on when you cash in your policy (whether in full or part), this may be considerably less than the total premiums you have paid. You should refer to the proposal for the illustrations of the cash value Manulife projects.

You are reminded to refer to the product leaflet or product guide for details of product risks.

The Bank, being registered with the Insurance Authority as a licensed insurance agency, is appointed as an insurance agency of Manulife for the distribution of life insurance products in the Hong Kong Special Administrative Region.

The Bank distributes the product for Manulife and the product is a product of Manulife but not the Bank.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank will enter into a Financial Dispute Resolution Scheme process with the customer.

This webpage is only for use in Hong Kong Special Administrative Region.

Important Information: Genesis is a life insurance plan provided and underwritten by Manulife (International) Limited (incorporated in Bermuda with limited liability) (“Manulife”). DBS Bank (Hong Kong) Limited (the “Bank”) is acting as a licensed insurance agency of Manulife. Please refer to the product leaflet, proposal and policy provision for the risk disclosures and exact terms and conditions of the plan.

*The projected rate of return stated in the advertisement is referring to the projected total internal rate of return. It is projected that the projected total internal rate of return can be up to 7.19% at the end of Policy Year 100, where this rate of return is not guaranteed, and is applicable to 5 years payment term policy with USD as the policy currency. ^Applicable to USD single premium policy, this projected breakeven year is not guaranteed.

The projected rate of return and projected breakeven year stated in the advertisement is not guaranteed and is for illustrative purposes only. Actual total internal rate of return maybe higher or lower than the stated value, and the actual breakeven year may also be earlier or later.

Apart from * and ^, the projected rate of return and projected breakeven year stated in the advertisement is based on the assumption that throughout the policy term, the policyholder (i) has not exercised Body and Mind Advance Benefit; (ii) has not taken out policy loan; (iii) has not exercised currency switch option;(iv) has not exercised Easy Choice / realization option; (v) has not made withdrawal through the reduction of notional amount; and (vi) has not exercised premium holiday and all annual premiums have been paid in full when due.

Terms and conditions apply.

Any premiums the policyholder paid would become part of the assets of Manulife and so the policyholder will be exposed to the credit risk of Manulife. The financial strength of Manulife may affect its ability to meet the ongoing obligations under the insurance policy. If the policyholder cash in the policy, the amount Manulife will pay is the surrender value worked out at the time the policyholder cash in the policy, less any amount owing to Manulife. Depending on when the policyholder cash in the policy (whether in full or part), this may be considerably less than the total premiums he/she has paid.

Apple, the Apple logo, iphone, Apple watch, touch id and face id are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc.

VISIT DBS.COM.HK | WEBSITE CONDITIONS OF USE | DATA POLICY

© COPYRIGHT. DBS BANK (HONG KONG) LIMITED 星展銀行(香港)有限公司