Whatever the market condition, there may be great value to be found if you do your homework.

Markets are constantly changing, with ebbs and flows, good and bad times. So it’s a useful skill to be able to identify stocks that might be worth investing in, in spite of the current market conditions.

But, where should you start?

That’s a fairly basic rule to follow and you would think that any investor would have the common sense to stay away from companies that have a hard-to-comprehend business model. But it is very easy to get carried away. The “herd mentality” can cloud your judgment and lead you to put your money into a company that operates in an area about which you have no idea.

"Know what you own, and know why you own it"

- US investment guru Peter Lynch

Learn what the company does, understand its business, its operations and its financials before you take the plunge. The next step is equally important: Always review your investments. What is a good investment today may not remain the same a few months down the road.

Collecting data from various sources to make an investment decision can be very cumbersome. Many investors prefer to use a stock screener. This tool allows you to select the industry that you want to target and analyse various companies based on pre-decided criteria.

It is possible to filter search results on the basis of:

- Total market capitalization - the market value of the company calculated by multiplying the share price of the stock with the number of shares outstanding

- Total revenue

- P/E ratio

- Dividend yield

You can quickly test out your ideas by using a stock screener.

Many investors will base their buying decisions on fundamental factors like revenue growth, profitability, return on equity, and the other data that affects a company’s performance. But there is another method that you can use to decide whether you should acquire a share at a particular price.

Technical analysis studies statistics and data related to market activity, so it pays to keep technical indicators in mind before you invest.

Here are 6 useful ways to identify an undervalued stock worth investing in.

There are times when a company’s share price falls rapidly over a short period. For many investors, this is a signal to take a closer look at what is happening within the company.

Why is that?

A company’s share price can fall for many reasons, including the release of quarterly financial results that fail to meet market expectations. However, there are times when the shares fall by more than is justified. In a situation like this, once you have ascertained that the company’s fundamentals are still intact, then you may have identified an undervalued stock.

This method of identifying an undervalued stock could be particularly useful for sectors, like commodities, which are cyclical in nature and susceptible to changes in the business cycle. That means the business tends to outperform the market when the economy is in expansion, but performs poorly during economic contraction.

If you are a long-term investor, a sector that is out of favour in the business cycle may be a good place to look for undervalued stocks.

A company that reports steadily growing earnings could be a good candidate for your money. Try and identify a firm that has reported increasing profits for the last five years or more. Then, determine if its business is sound and offers further growth potential using fundamental analysis. As a word of caution, past performance is not necessarily an indication of future performance.

Of course, there may be a situation where the share price is already at a level that indicates that the market has factored in this possibility. Therefore, it is prudent to make a buying decision only after considering other details about the target company in addition to its earnings growth.

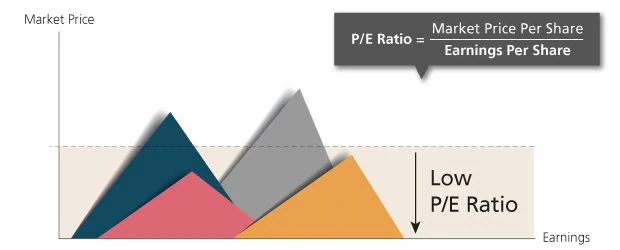

The price to earnings ratio is a good place to start if you are looking for an undervalued company. The P/E ratio is calculated like this.

It tells you the number of times that the market price of a stock is higher than its earnings per share, or how much an investor is willing to pay for $1 of the company’s earnings. A higher ratio might mean it would take a long period for an investor to recover their capital investment.

A low P/E ratio could signal a potential buying opportunity. But remember that this is only one of the factors that you must consider. A depressed price to earnings ratio could also mean that the market has advance information about the company’s poor performance.

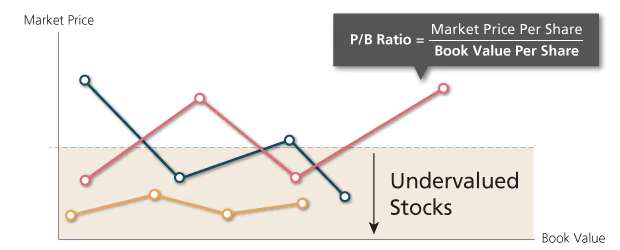

The price to book ratio signifies the number of times that a company’s market price is greater than the book value of its equity. It is calculated in this manner.

When the P/B ratio is less than 1, it signifies that investors believe that the firm is not able to utilise its assets profitably. It could also mean that you have spotted a buying opportunity.

A firm with a low price to book ratio deserves your attention. If it meets other investment criteria, you could have spotted a stock that will provide high returns in the months and years ahead.

This financial ratio tells you how a company’s dividend payout compares with its market price. A high ratio may be a sign that the firm is undervalued.

But it is wise to proceed with caution. Are the profits sufficient to sustain the generous level of dividends? It may also be the case that the company is unable to deploy its surplus funds effectively and is paying higher dividends because of this reason.

Financial data and ratio analysis can point you in the right direction, but it would be a mistake to base your investment decision entirely on the conclusions that you draw from numerical calculations. There is a wealth of information available in the target company’s annual report and in press reports. It is absolutely essential that you gather as many details as you can before you invest your money.

There is one non-numerical technique that will be of great help in your hunt for a stock that offers the possibility of capital appreciation. Warren Buffett says that when he is researching a company, one of the primary issues that he considers is whether it can effectively keep the competition at bay. He compares this ability to a castle’s moat. A firm should be able to ward off its competitors in the same manner as a moat keeps attackers from getting into a castle.

But it is important to remember that a “moat” cannot last forever. There are scores of companies that have lost their competitive advantage over the years. Before you take an investment decision, it is crucial that you conduct careful research not only about the company, but also about the industry that it operates in and its competitors.

Risk Disclosure and Important Notice

The information herein is for information only. DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this publication or its contents

Investment involves risks. The information provided is based on sources which DBS Bank Limited and DBS Bank (Hong Kong) Limited believe to be reliable but has not been independently verified. Any projections and opinions expressed herein are expressed solely as general market commentary and do not constitute solicitation, recommendation, investment advice, or guaranteed return. The above information does not constitute any offer or solicitation of offer to subscribe, transact or redeem any investment product. Past performances are not indicative of future performances. You should make investment decisions based on your own investment objective and experience, financial situation and particular needs. You should carefully read the product offering documentation, the account terms and conditions and the product terms and conditions for detailed product information and risk factors prior to making any investment. If you have any doubt on this material or any product offering documentation, you should seek independent professional advice.

Securities trading is an investment. The prices of stocks fluctuate, sometimes dramatically. The price of a stock may move up or down and may become valueless. It is as likely that losses will be incurred rather than profits made as a result of trading stocks. The investment decision is yours but you should not invest in any stock unless you have taken into account that the relevant stock is suitable for you having regard to your financial situation, investment experience and investment objectives.

Customers should be aware that the prices of the Callable Bull / Bear Contracts and Warrants may fall in value as rapidly as they may rise and holders may sustain a total loss of their investment. The Bank does not provide securities advisory service. Any person considering an investment should seek independent advice on the investment suitability when considered necessary.

The information provided above have not been reviewed by the Securities and Futures Commission of Hong Kong or any regulatory authority in Hong Kong.