- ECB cut rates for the third consecutive time amid disinflation, contracting manufacturing, and weak exports

- Corporate earnings are falling short of expectations with the growth forecast for FY24 cut from 4.3% to 1.8%

- Trade tariff negotiations add further headwinds to the region’s bleak growth outlook, given that China is EU’s second largest trading partner

- Maintain cautious stance on European markets amid economic headwinds and disappointing corporate earnings; quiet luxury, healthcare, and select tech players remain our preference

Related Insights

Bleak growth outlook. The European Central Bank (ECB) has cut its benchmark interest rates by 25 bps for the third time this year, bringing the deposit facility rate to 3.25%. The ongoing disinflationary trend was cited as the primary driver for the consecutive rate cuts. Driven by a sharper drop in energy prices and softer services inflation, Euro Area inflation continued its decline, falling below the ECB’s 2% target to 1.7% in September, down from 2.2% in August.

Meanwhile, the region’s Purchasing Managers' Index slipped into contractionary territory. Core member countries, particularly those heavily reliant on manufacturing, are grappling with a mix of challenges, including rising competition and sluggish demand for key exports such as automobiles and capital goods. This has resulted in a slower recovery in exports and dampened investment sentiment across the bloc. Notably, Germany, Europe’s largest economy, has downgraded its growth outlook, now forecasting a 0.2% contraction in 2024, a reversal from the previously expected 0.3% growth. This marks the second consecutive year of negative growth, following a 0.3% contraction in 2023.

In light of these developments, we have revised our rate cut projections, now anticipating an additional reduction in 4Q24, followed by further cuts in the first half of 2025 to bring the neutral rate to 2.0%. There are also growing discussions within the ECB on whether rates should be lowered below neutral to further stimulate the sluggish economy.

Earnings coming in short. Europe equities had a dismal start to October as the earnings season fell short of expectations, prompting downward revisions in forecasts. Of the 56 companies in the STOXX 600 that have reported earnings so far, 26 have missed expectations. As a result, the initial earnings growth forecast for FY24 has been slashed from 4.3% to 1.8%. Looking ahead, we anticipate that the 9% earnings growth forecast for next year will also be revised downward, given weak corporate guidance and ongoing headwinds from tariff negotiations.

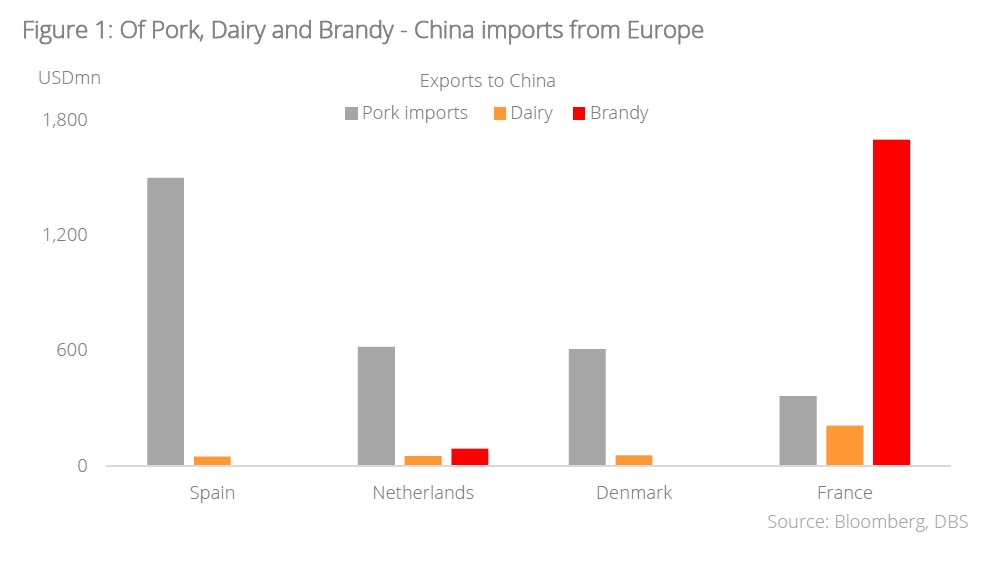

In response to the EU's decision to impose tariffs of up to 45% on Chinese-made electric vehicles (EVs), China's Ministry of Commerce has announced provisional anti-dumping measures on brandy imports from the EU. Additionally, China is conducting investigations into EU pork and dairy imports and is considering raising tariffs on imported large fuel vehicles. With China being EU's second largest trading partner, accounting for approximately 6% of total trade, these retaliatory actions are likely to create further challenges for European economies and corporations.

Delayed positive impact from China stimulus. China is a crucial market for many European industries. While Beijing's recent announcements of large-scale stimulus measures ignited some optimism, the lack of specificities has left uncertainty on whether China can restart its growth engine. Furthermore, overhang from China-Europe trade tariffs, coupled with US restrictions on technology exports to China, are likely to delay positive repercussions.

French luxury giant LVMH reported weak quarterly sales, primarily driven by sluggish demand in China. Although semiconductor equipment maker ASML exceeded earnings expectations, it issued a cautious outlook due to the uncertain environment. According to calculations from Reuters data, approximately 10% of European corporate earnings are derived from China/Asia, underscoring the region's importance in contributing to Europe's economic fortunes.

Energy prices a concern for the region. Ongoing turmoil in the Middle East is adding to volatility in energy markets with concerns mounting over potential threats to critical energy infrastructure in the region. As supply risks increase and climate uncertainties persist, the upcoming winter season could drive energy prices higher. This poses a significant risk to the global disinflationary trend and could limit the ECB's ability to implement further rate cuts which are crucial for supporting the region’s slowing economy.

Given these challenges, we maintain a cautious stance on European markets, particularly in light of economic headwinds and disappointing corporate earnings. However, we remain optimistic about long-term structural themes with quiet luxury, technology, and healthcare continuing to be our investment preferences, while renewables present fresh opportunities.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.