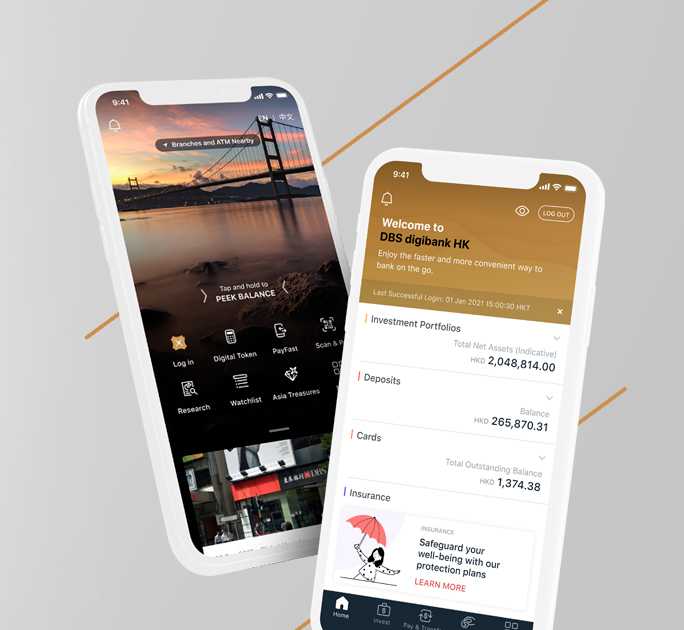

Wealth management

for the way you live today.

It's faster, smarter and more connected. Gain access to all the financial expertise, market insights and investment tools to grow your wealth.Learn More

Market Insights

Make sharp investments with the latest market overviews and insightful analysis from the award-winning team at our Chief Investment Office.

Featured

Be in the know of the latest news and promotions or tap on expert insights.

Quick Access

An overview of major markets and currency exchange rates.